Log In/Sign Up

Your email has been sent.

1100 Eisenhower Place 1100 Eisenhower Pl 39,450 SF Vacant Flex Building Online Auction Sale Ann Arbor, MI 48108

Matterport 3D Tour

INVESTMENT HIGHLIGHTS

- Exceptional Owner/User play.

- Property features a loading dock and truck well.

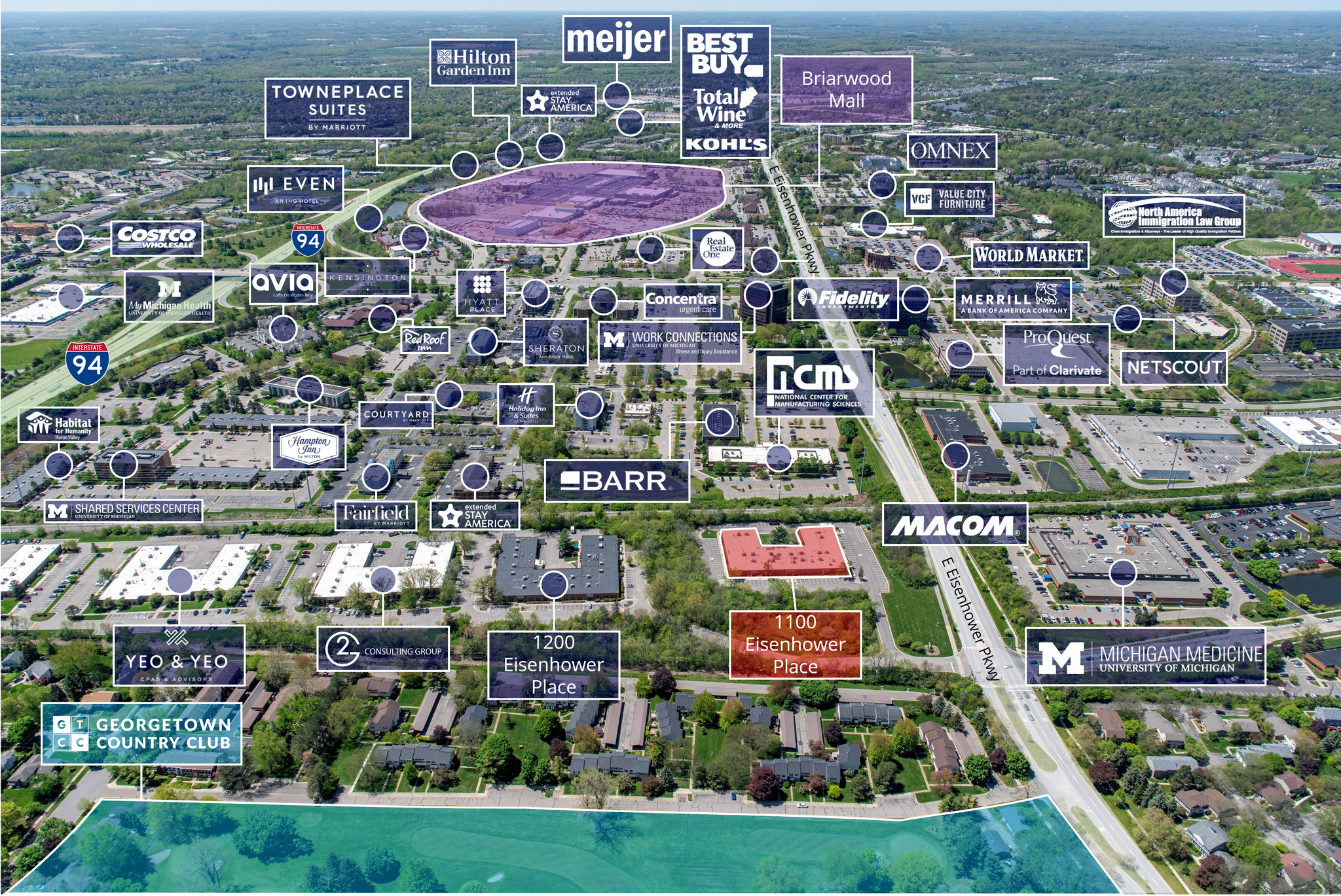

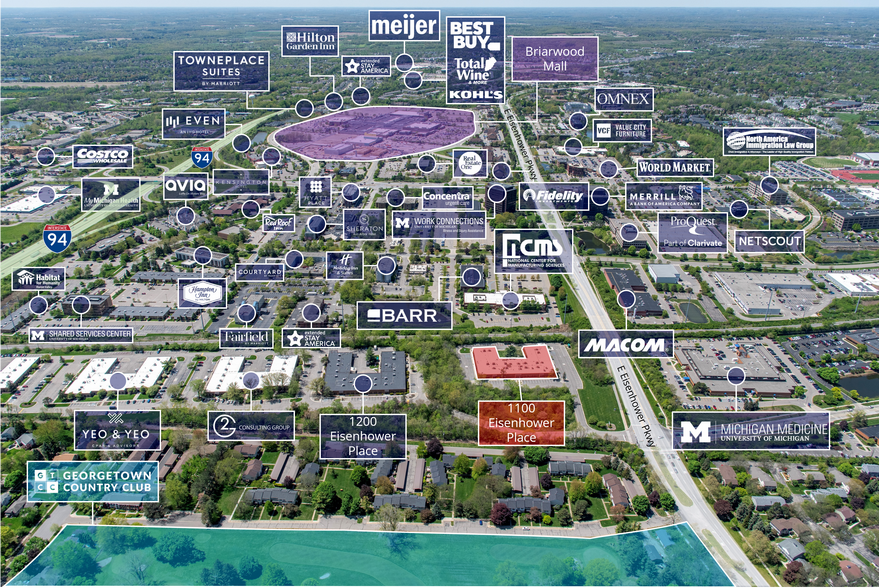

- Close proximity to Briarwood Mall and numerous hotel and restaurant options.

- Well-maintained flex R&D asset within Ann Arbor’s industrial and flex market with opportunities for synergistic tenant growth and relationships.

- Quick and convenient access to I-94 and US-23.

- Located less than 10 minutes South of U of M – Ann Arbor’s campus.

EXECUTIVE SUMMARY

Colliers is pleased to present for sale the 100 percent fee simple interest in 1100 Eisenhower Place (the “Property” or the “Asset”) in Ann Arbor, Michigan. Built in 1982 and renovated in 2007, the 39,450-square-foot, vacant, flex Asset is an excellent opportunity for an Owner/User or an investor looking to acquire a well-maintained Asset in the Ann Arbor market.

The flex Asset features 3,945 SF of Industrial space and 35,505 SF of Office space along with a loading dock, a truck well, and 14’ clear heights. The Property has ample parking for employees and clients alike, with 135 surface spaces available corresponding to a parking ratio of 6.00/1,000 SF. The Property also offers an excellent location with quick and convenient access to both I-94 and US-23, allowing for larger local and regional access.

There are 6.9M square feet of flex/R&D assets within a 5-mile radius of 1100 Eisenhower Place. With no new construction and a positive 12-month net absorption of 89K square feet, the immediate flex/R&D market is performing well and continues to demonstrate a strong tenant demand. With only a 6.6% vacancy rate, this Property offers a unique and important opportunity for interested tenants within the Ann Arbor market and surrounding areas. Nearby industrial, office, and flex tenants offer potential for synergistic relationships with a future tenant(s) at 1100 Eisenhower Place. The Property is also located 2.5 Miles south of University of Michigan’s campus.

Furthermore, the Asset is located in close proximity to Briarwood Mall, a 980K SF class A mall, home to 14 eateries and 85 shops. The Property is also located near multiple hotels and restaurant options. Hotels include the Courtyard, Sheraton, Hampton Inn, Hyatt Place, the Kensington Hotel, EVEN Hotel, TownePlace Suites, Hilton Garden Inn, Extended Stay America, and Sonesta Simply Suites. Nearby restaurants include Buffalo Wild Wings, Wendy’s, Seoul Garden, Olive Garden, Buddy’s Pizza, Texas Roadhouse, the Great Greek Mediterranean Grill, Zingerman’s Bakehouse, and Black Rock Bar & Grill.

Overall, the Asset represents an excellent opportunity for an Owner/User or investor to acquire a well-maintained flex property in the Ann Arbor market.

The flex Asset features 3,945 SF of Industrial space and 35,505 SF of Office space along with a loading dock, a truck well, and 14’ clear heights. The Property has ample parking for employees and clients alike, with 135 surface spaces available corresponding to a parking ratio of 6.00/1,000 SF. The Property also offers an excellent location with quick and convenient access to both I-94 and US-23, allowing for larger local and regional access.

There are 6.9M square feet of flex/R&D assets within a 5-mile radius of 1100 Eisenhower Place. With no new construction and a positive 12-month net absorption of 89K square feet, the immediate flex/R&D market is performing well and continues to demonstrate a strong tenant demand. With only a 6.6% vacancy rate, this Property offers a unique and important opportunity for interested tenants within the Ann Arbor market and surrounding areas. Nearby industrial, office, and flex tenants offer potential for synergistic relationships with a future tenant(s) at 1100 Eisenhower Place. The Property is also located 2.5 Miles south of University of Michigan’s campus.

Furthermore, the Asset is located in close proximity to Briarwood Mall, a 980K SF class A mall, home to 14 eateries and 85 shops. The Property is also located near multiple hotels and restaurant options. Hotels include the Courtyard, Sheraton, Hampton Inn, Hyatt Place, the Kensington Hotel, EVEN Hotel, TownePlace Suites, Hilton Garden Inn, Extended Stay America, and Sonesta Simply Suites. Nearby restaurants include Buffalo Wild Wings, Wendy’s, Seoul Garden, Olive Garden, Buddy’s Pizza, Texas Roadhouse, the Great Greek Mediterranean Grill, Zingerman’s Bakehouse, and Black Rock Bar & Grill.

Overall, the Asset represents an excellent opportunity for an Owner/User or investor to acquire a well-maintained flex property in the Ann Arbor market.

MATTERPORT 3D TOUR

1 of 1

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

OFFERING MEMORANDUM Click Here to Access

DATA ROOM Click Here to Access

- Offering Memorandum

- Operating and Financials

- Purchase Agreement

- Third Party Reports

- Title and Insurance

- Survey

- Site Plan + Floor Plan

MARKET ANALYTICS Click Here to Access

PROPERTY FACTS

| Sale Type | Investment | No. Stories | 1 |

| Sale Condition | Auction Sale | Year Built/Renovated | 1982/2007 |

| Type of Ownership | Fee Simple | Tenancy | Single |

| Property Type | Flex | Parking Ratio | 6/1,000 SF |

| Property Subtype | Flex Research & Development | Clear Ceiling Height | 14’ |

| Building Class | B | No. Dock-High Doors/Loading | 1 |

| Lot Size | 3.22 AC | Parcel Number | 12-09-202-001 |

| Rentable Building Area | 39,450 SF | ||

| Zoning | M1 - Industrial Zoned District | ||

| Sale Type | Investment |

| Sale Condition | Auction Sale |

| Type of Ownership | Fee Simple |

| Property Type | Flex |

| Property Subtype | Flex Research & Development |

| Building Class | B |

| Lot Size | 3.22 AC |

| Rentable Building Area | 39,450 SF |

| No. Stories | 1 |

| Year Built/Renovated | 1982/2007 |

| Tenancy | Single |

| Parking Ratio | 6/1,000 SF |

| Clear Ceiling Height | 14’ |

| No. Dock-High Doors/Loading | 1 |

| Zoning | M1 - Industrial Zoned District |

| Parcel Number | 12-09-202-001 |

AMENITIES

- Bio-Tech/ Lab Space

- Signage

- Wheelchair Accessible

- Reception

- Storage Space

- Air Conditioning

- Smoke Detector

UTILITIES

- Heating - Gas

SPACE AVAILABILITY

- SPACE

- SIZE

- SPACE USE

- CONDITION

- AVAILABLE

| Space | Size | Space Use | Condition | Available |

| 1st Floor | 39,450 SF | Office | Full Build-Out | Now |

1st Floor

| Size |

| 39,450 SF |

| Space Use |

| Office |

| Condition |

| Full Build-Out |

| Available |

| Now |

1 of 6

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1st Floor

| Size | 39,450 SF |

| Space Use | Office |

| Condition | Full Build-Out |

| Available | Now |

DEMOGRAPHICS

REGIONAL ACCESSIBILITY

CITY

POPULATION

MILES

DRIVE TIME

Detroit

672,662

41

0 h 50 m

Columbus

892,533

188

3 h 39 m

Chicago

2,705,994

248

4 h 41 m

Indianapolis

867,125

257

4 h 56 m

Washington

702,455

520

9 h 52 m

Philadelphia

1,584,138

579

10 h 45 m

ACCESS AND LABOR FORCE

10 MILES

Total Population

310,377

Total Labor Force

165,938

Unemployment Rate

3.59%

Median Household Income

$75,172

Warehouse Employees

23,849

High School Education Or Higher

95.80%

$ values in USD

SALE ADVISORS

Barry Swatsenbarg, Executive Vice President

In 2015, Barry joined Colliers International to expand the Colliers Detroit office reach with his investment sales expertise. He is consistently in the top 200 nationally for Colliers. Barry has been an active investment sales agent for over 24 years, transacted on over 500 deals; 15,000 apartment units and more than 30M SF of commercial assets. Barry has been awarded Everest Club at Colliers for the last several years. (The Everest Club recognizes the top 10% of producers and is Colliers highest award.)

Through his activity with the valuation and disposition of value-add and stabilized, income producing properties, he has successfully worked through periods of economic growth and contraction. He has an extensive history of producing sale results with outside of the box solutions to maximize value.

Over the years, Barry has transacted on hundreds of complicated dispositions, that included receivership, lender debt, REO and stabilized assets. He operates exclusively as a sell-side broker, with transactions spreading across all major investment commercial real estate property types. He has navigated through multitudes of unique and complex scenarios.

Barry is regarded as a highly trusted and well-connected industry expert. He is called upon by financial institutions, private clients and peers alike, for his candid market insight and ability to create effective asset management plans for disposition to aid clients with their ongoing business planning. The results maximize value; regardless of the quality of the asset.

Through his activity with the valuation and disposition of value-add and stabilized, income producing properties, he has successfully worked through periods of economic growth and contraction. He has an extensive history of producing sale results with outside of the box solutions to maximize value.

Over the years, Barry has transacted on hundreds of complicated dispositions, that included receivership, lender debt, REO and stabilized assets. He operates exclusively as a sell-side broker, with transactions spreading across all major investment commercial real estate property types. He has navigated through multitudes of unique and complex scenarios.

Barry is regarded as a highly trusted and well-connected industry expert. He is called upon by financial institutions, private clients and peers alike, for his candid market insight and ability to create effective asset management plans for disposition to aid clients with their ongoing business planning. The results maximize value; regardless of the quality of the asset.

Matt Terrace, Senior Vice President- Investments

For close to a decade Matt has completely immersed himself in many different aspects of commercial real estate, from retail to development to construction to acquisitions and dispositions, but specializes in Commercial Investment Dispositions and Acquisitions. Matt was exposed to the industry at a young age as it is a family passion handed down through generations. Matt has served both private and institutional clients such as Garrison Investment Group, True North Investments, LNR Partners, Integris Ventures and Alidade Capital. He has also worked with a number of national Tenants in the market including Pet Supplies Plus, Czarnowski and Nuance Communications. Matt’s successful approach stems from the ideology of fully comprehending his client’s needs and consistently putting them first.

Jonathan Katz, Senior Vice President

Jonathan joined Colliers in May of 2025 after serving as a Managing Director for Ten-X, one of the largest CRE online marketplaces. He entered the commercial real estate industry in 2012 as a Client Manager for Auction.com, which later rebranded to Ten-X. There, he quickly developed a deep understanding of the CRE Auction process and online marketplace dynamics. His career advanced as a Senior Sales Director, where he spent over a decade helping Ten-X become a leader in the CRE auction space. Having facilitated over $2B of CRE and Note sales, he brings his leadership and distinct knowledge to help grow Colliers’ presence in the CRE Auction industry.

Bradley Carver, Senior Vice President

Bradley joined Colliers in June 2025 and brings over a decade of leadership experience in the commercial real estate (CRE) auction space. Prior to Colliers, he served as Managing Director at Ten-X, one of the largest online marketplaces for CRE transactions, where he was instrumental in executing over $2 billion in CRE and note sales.

At Colliers, Bradley leverages his extensive industry experience, strong professional network, and hands-on knowledge of property marketing and disposition, particularly with opportunistic and income-producing assets. Known for his service-oriented mindset, proven track record, and deep passion for the auction space, he delivers strategic, high-impact marketing solutions designed to maximize asset exposure.

At Colliers, Bradley leverages his extensive industry experience, strong professional network, and hands-on knowledge of property marketing and disposition, particularly with opportunistic and income-producing assets. Known for his service-oriented mindset, proven track record, and deep passion for the auction space, he delivers strategic, high-impact marketing solutions designed to maximize asset exposure.

ABOUT THE AUCTION TECHNOLOGY

Auctions by Ten-X are the #1 transaction technology powering commercial real estate transactions online. With over $34B in total transactions, these auctions use best-in-class technology and real-time asset intelligence to put listings in the best position to find the perfect buyer. The expedited auction timeline, comprehensive due diligence, and buyer qualification make transactions twice as fast and twice as certain for brokers, owners, and investors.

Read More

AUCTION CONTACT

Jameson Kuykendall

Contact

Auctioneer License:

Ten-X, LLC Arlene Richardson RE Brkr 6505431586

1 of 19

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

3% Transaction Fee

Based on Winning Bid Amount

Minimum Transaction Fee

$20,000 USD

Maximum Transaction Fee

$300,000 USD

Example Calculation

Winning Bid Amount

$5,000,000 USD

Transaction Fee

$150,000 USD (3%)

Total Purchase Price

$5,150,000 USD

Presented by

1100 Eisenhower Place | 1100 Eisenhower Pl

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Presented by

1100 Eisenhower Place | 1100 Eisenhower Pl

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.