Log In/Sign Up

Your email has been sent.

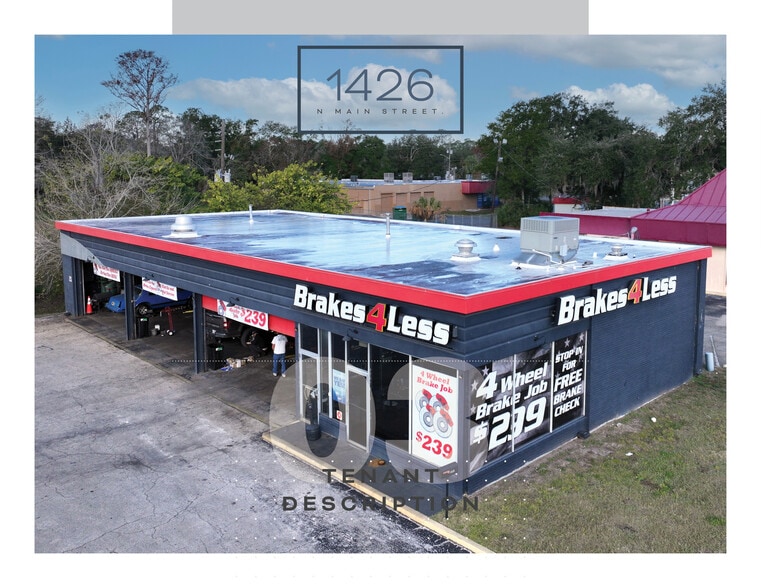

1426 N Main St

Gainesville, FL 32601

Retail Property For Sale

Investment Highlights

- Strong Cash Flow Visibility: Long lease with rent escalations and multiple renewal options remaining.

- College Town: 60K+ students attend University of Florida creating a built-in, recession resistant demand

- Located on N Main Street, a major Gainesville corridor with strong daily traffic and ideal conditions for a high-demand auto service use.

- Zero Management Required: Absolute Net Lease offers passive income, zero landlord obligations, and annual income predictability.

- Below-market rents provide immediate affordability and tenant stability while providing future NOI growth potential upon renewal or re-tenanting.

Executive Summary

CBRE is pleased to present an opportunity to acquire a 3,294 SF, single tenant asset occupied by Brakes 4 Less located in Gainesville, Florida. The property sits just 2 miles from the University of Florida, an institution that supports 62,000+ students and ~6,700 faculty. The asset benefits from its close proximity to the university as well as a densely populated 3-mile radius of 75,501 residents, giving the shop a competitive advantage for customers seeking close, convenient auto service. Brakes 4 Less just signed a new 10 year net lease with built in 2% annual increases starting in year five (5), and has four (4) 5-year options to renew, giving the owner long-term cash flow predictability with zero landlord obligations.

Gainesville sits in North Central Florida, making it a regional hub with excellent connectivity. The city is directly served by I-75, a major freight and commuter artery linking Gainesville to Atlanta (north) and Tampa/Miami (south), establishing it as a strong logistics and access point. This robust transportation infrastructure benefits service-oriented single tenant investments by ensuring high accessibility for customers, employees, and deliveries, a key asset attribute that supports stable tenancy and long-term value.

Expanding beyond the city core, the Gainesville Metropolitan Statistical Area (MSA), which includes Alachua, Gilchrist, and Levy counties, has a population closer to 355,000+ and continues steady growth. What this means for investors:

• A stable and growing population base supports long-term demand for goods and services

• The large student population (60k+ at UF) injects consistent consumer demand across service, retail, food and convenience segments year-round.

Gainesville combines strategic location, stable economic drivers, growing demographics, and strong transportation access; a compelling combination for investors targeting a single-tenant asset with long-term cash flow potential and no landlord responsibilities.

Gainesville sits in North Central Florida, making it a regional hub with excellent connectivity. The city is directly served by I-75, a major freight and commuter artery linking Gainesville to Atlanta (north) and Tampa/Miami (south), establishing it as a strong logistics and access point. This robust transportation infrastructure benefits service-oriented single tenant investments by ensuring high accessibility for customers, employees, and deliveries, a key asset attribute that supports stable tenancy and long-term value.

Expanding beyond the city core, the Gainesville Metropolitan Statistical Area (MSA), which includes Alachua, Gilchrist, and Levy counties, has a population closer to 355,000+ and continues steady growth. What this means for investors:

• A stable and growing population base supports long-term demand for goods and services

• The large student population (60k+ at UF) injects consistent consumer demand across service, retail, food and convenience segments year-round.

Gainesville combines strategic location, stable economic drivers, growing demographics, and strong transportation access; a compelling combination for investors targeting a single-tenant asset with long-term cash flow potential and no landlord responsibilities.

Property Facts

Sale Type

Investment

Property Type

Retail

Property Subtype

Auto Repair

Building Size

3,294 SF

Building Class

C

Year Built/Renovated

1974/1985

Price

$1,162,146 CAD

Price Per SF

$352.81 CAD

Cap Rate

5.60%

NOI

$65,080 CAD

Tenancy

Single

Building Height

1 Story

Building FAR

0.24

Lot Size

0.31 AC

Zoning

BA

Frontage

97’ on N Main St

Amenities

- Bus Line

- Pylon Sign

- Signage

Property Taxes

| Parcel Number | 09876-002-001 | Improvements Assessment | $113,942 CAD |

| Land Assessment | $184,625 CAD | Total Assessment | $298,567 CAD |

Property Taxes

Parcel Number

09876-002-001

Land Assessment

$184,625 CAD

Improvements Assessment

$113,942 CAD

Total Assessment

$298,567 CAD

1 of 8

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map