Log In/Sign Up

Your email has been sent.

Below replacement cost at $121 psf ! 3861 Auburn St 15,550 SF Retail Building Rockford, IL 61101 $2,610,620 CAD ($167.89 CAD/SF) 8.30% Cap Rate

INVESTMENT HIGHLIGHTS

- Investment Grade Tenant – Dollar Tree (NASDAQ: DLTR) is S&P rated BBB.

- Long Term Corporate Lease – 10-year lease with Three (5-year) option periods (rent increases throughout the primary term and the option periods).

- property includes Chase Bank ATM

- Net Net Leased Property. Minimal landlord responsibilities!! (Complete Interior Remodel in 2024)

- As of February 23, 2024, Dollar Tree has a market cap or net worth of $31.78 billion.

- Perfect for 1031 exchange at a price of $1,888,333 and a blended cap rate for both the Dollar Tree & Chase ATM of 8.30%.

EXECUTIVE SUMMARY

For a complete Offering Memorandum, please click on the left side under the property image. For additional details or to submit an offer, contact Ray Pardilla at 707-652-8363.

We are pleased to present a brand-new 10-year lease in a fully renovated Dollar Tree, located just 89 miles from Chicago. The property is Net Net Leased (NN), offering minimal landlord responsibilities, with potential tenant reimbursements as specified in the lease. The lease includes three five-year renewal options, with a $0.50 per square foot rental increase every five years, applicable during both the initial term and the renewal periods. This lease is corporately guaranteed by Dollar Tree, which holds an S&P "BBB" investment-grade rating.

Rent commenced on May 31, 2024, with the lease set to expire on May 31, 2034. This Family Dollar | Dollar Tree store is strategically positioned at the corner of North Central Ave. and Auburn St., next to high-traffic neighbors such as Walgreens and McDonald's, offering excellent visibility and foot traffic.

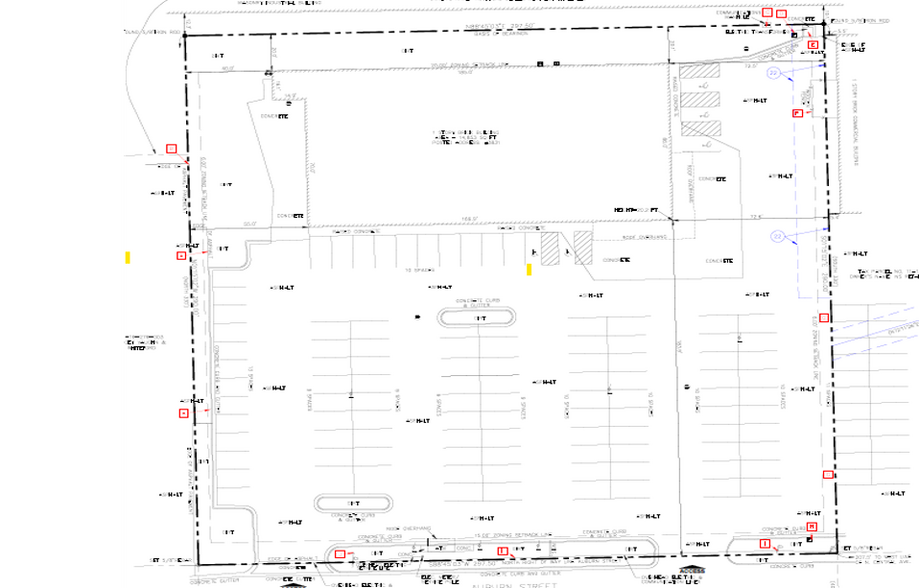

The extensively remodelled the property to the Tenants strict standards in 2023 and 2024 and includes a 15,550-square-foot building on a 1.79-acre lot, making it an ideal option for 1031 exchange buyers. The asking price for this investment is $1,732,147, generating a Net Operating Income (NOI) of $141,170 annually, resulting in a competitive cap rate of 8.15%.

Additionally, the property includes an ATM lease expiring on January 31, 2025, with the tenant having occupied the location since 2006 and one three-year renewal option, featuring a 5% rent increase. The combined asking price for the Dollar Tree and ATM is $1,888,333 at an 8.30% CAP.

This investment offers both long-term stability and a strong return, making it an excellent choice for investors seeking a solid, corporate-backed lease in a prime retail location.

We are pleased to present a brand-new 10-year lease in a fully renovated Dollar Tree, located just 89 miles from Chicago. The property is Net Net Leased (NN), offering minimal landlord responsibilities, with potential tenant reimbursements as specified in the lease. The lease includes three five-year renewal options, with a $0.50 per square foot rental increase every five years, applicable during both the initial term and the renewal periods. This lease is corporately guaranteed by Dollar Tree, which holds an S&P "BBB" investment-grade rating.

Rent commenced on May 31, 2024, with the lease set to expire on May 31, 2034. This Family Dollar | Dollar Tree store is strategically positioned at the corner of North Central Ave. and Auburn St., next to high-traffic neighbors such as Walgreens and McDonald's, offering excellent visibility and foot traffic.

The extensively remodelled the property to the Tenants strict standards in 2023 and 2024 and includes a 15,550-square-foot building on a 1.79-acre lot, making it an ideal option for 1031 exchange buyers. The asking price for this investment is $1,732,147, generating a Net Operating Income (NOI) of $141,170 annually, resulting in a competitive cap rate of 8.15%.

Additionally, the property includes an ATM lease expiring on January 31, 2025, with the tenant having occupied the location since 2006 and one three-year renewal option, featuring a 5% rent increase. The combined asking price for the Dollar Tree and ATM is $1,888,333 at an 8.30% CAP.

This investment offers both long-term stability and a strong return, making it an excellent choice for investors seeking a solid, corporate-backed lease in a prime retail location.

PROPERTY FACTS

Sale Type

Investment or Owner User

Property Type

Retail

Property Subtype

Freestanding

Building Size

15,550 SF

Building Class

C

Year Built

2023

Price

$2,610,620 CAD

Price Per SF

$167.89 CAD

Cap Rate

8.30%

NOI

$216,682 CAD

Tenancy

Single

Building Height

1 Story

Building FAR

0.20

Lot Size

1.79 AC

Zoning

C2

Frontage

270’ on Auburn St

AMENITIES

- Air Conditioning

- Smoke Detector

PROPERTY TAXES

| Parcel Number | 11-16-276-008 | Improvements Assessment | $486,798 CAD |

| Land Assessment | $83,248 CAD | Total Assessment | $570,045 CAD |

PROPERTY TAXES

Parcel Number

11-16-276-008

Land Assessment

$83,248 CAD

Improvements Assessment

$486,798 CAD

Total Assessment

$570,045 CAD

1 of 3

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

Below replacement cost at $121 psf ! | 3861 Auburn St

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.