Log In/Sign Up

Your email has been sent.

INVESTMENT HIGHLIGHTS

- Long term tenant recently signed a six year extension that expires June 30th, 2031

- Tenant is responsible for repairs and maintenance of the roof

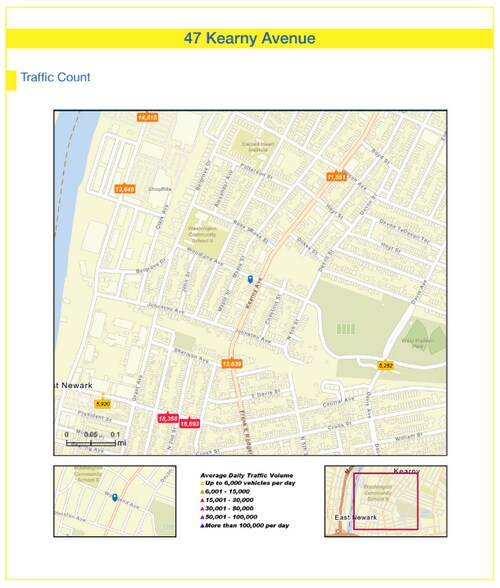

- Busy retail and office corridor

- Tenant is responsible for the maintenance and repairs to the building except for the structural portions of the building

- Tenant is fully responsible for the taxes which were $8,885.15 in the latest tax year (2024)

- In close proximity to Routes 21 and 280; approximately one mile to the Harrison Path Station

EXECUTIVE SUMMARY

In close proximity to Routes 21 and 280; approximately one mile to the Harrison Path Station

Details:

• Long term tenant recently signed a six year extension that expires June 30th, 2031

• Tenant is responsible for the maintenance and repairs to the building except for the structural portions of the building

• Tenant is responsible for repairs and maintenance of the roof

• Tenant is fully responsible for the taxes which were $8,885.15 in the latest tax year (2024)

• Busy retail and office corridor

Details:

• Long term tenant recently signed a six year extension that expires June 30th, 2031

• Tenant is responsible for the maintenance and repairs to the building except for the structural portions of the building

• Tenant is responsible for repairs and maintenance of the roof

• Tenant is fully responsible for the taxes which were $8,885.15 in the latest tax year (2024)

• Busy retail and office corridor

DATA ROOM Click Here to Access

FINANCIAL SUMMARY (ACTUAL - 2026) |

ANNUAL (CAD) | ANNUAL PER SF (CAD) |

|---|---|---|

| Gross Rental Income |

$58,102

|

$31.07

|

| Other Income |

-

|

-

|

| Vacancy Loss |

-

|

-

|

| Effective Gross Income |

$58,102

|

$31.07

|

| Taxes |

-

|

-

|

| Operating Expenses |

$2,767

|

$1.48

|

| Total Expenses |

$2,767

|

$1.48

|

| Net Operating Income |

$55,336

|

$29.59

|

FINANCIAL SUMMARY (ACTUAL - 2026)

| Gross Rental Income (CAD) | |

|---|---|

| Annual | $58,102 |

| Annual Per SF | $31.07 |

| Other Income (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Vacancy Loss (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Effective Gross Income (CAD) | |

|---|---|

| Annual | $58,102 |

| Annual Per SF | $31.07 |

| Taxes (CAD) | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Operating Expenses (CAD) | |

|---|---|

| Annual | $2,767 |

| Annual Per SF | $1.48 |

| Total Expenses (CAD) | |

|---|---|

| Annual | $2,767 |

| Annual Per SF | $1.48 |

| Net Operating Income (CAD) | |

|---|---|

| Annual | $55,336 |

| Annual Per SF | $29.59 |

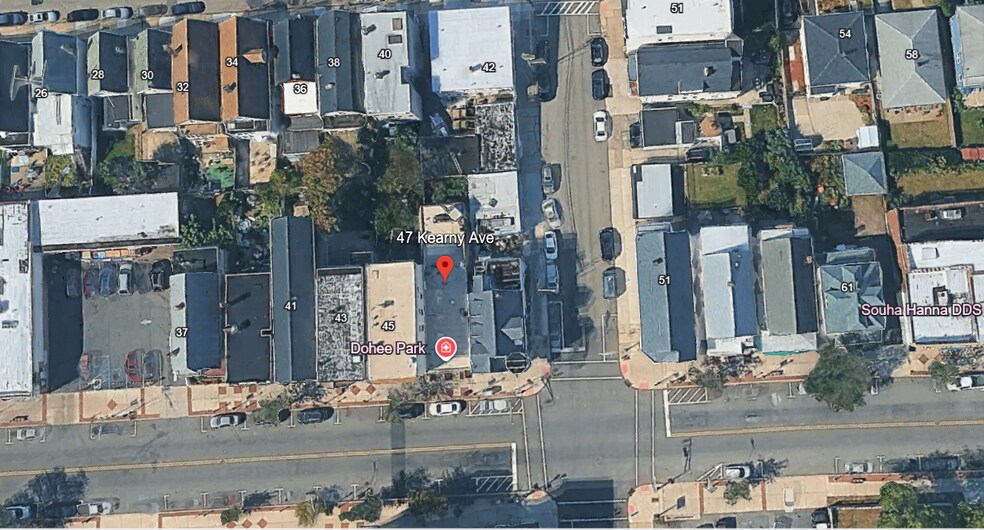

PROPERTY FACTS Under Contract

Sale Type

Investment

Property Type

Office

Property Subtype

Building Size

1,870 SF

Building Class

C

Year Built/Renovated

1949/2008

Price

$1,106,000 CAD

Price Per SF

$591.44 CAD

Cap Rate

5%

NOI

$55,300 CAD

Tenancy

Single

Building Height

1 Story

Typical Floor Size

1,870 SF

Building FAR

0.75

Lot Size

0.06 AC

Zoning

Retail/Commercial - C3 - Community Business

MAJOR TENANTS

- TENANT

- INDUSTRY

- SF OCCUPIED

- RENT/SF

- LEASE TYPE

- LEASE END

- Hudson Park Dental

- Health Care and Social Assistance

- -

- $31.05 CAD

- Triple Net

- Jun 2031

| TENANT | INDUSTRY | SF OCCUPIED | RENT/SF | LEASE TYPE | LEASE END | |

| Hudson Park Dental | Health Care and Social Assistance | - | $31.05 CAD | Triple Net | Jun 2031 |

Walk Score®

Walker's Paradise (93)

PROPERTY TAXES

| Parcel Number | 07-00011-0000-00021 | Total Assessment | $114,748 CAD (2025) |

| Land Assessment | $34,563 CAD (2025) | Annual Taxes | $0 CAD ($0.00 CAD/SF) |

| Improvements Assessment | $80,185 CAD (2025) | Tax Year | 2026 Payable 2026 |

PROPERTY TAXES

Parcel Number

07-00011-0000-00021

Land Assessment

$34,563 CAD (2025)

Improvements Assessment

$80,185 CAD (2025)

Total Assessment

$114,748 CAD (2025)

Annual Taxes

$0 CAD ($0.00 CAD/SF)

Tax Year

2026 Payable 2026

1 of 4

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

47 Kearny Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.