Log In/Sign Up

Your email has been sent.

7310 Peppers Ferry Blvd

Fairlawn, VA 24141

Retail Property For Sale

INVESTMENT HIGHLIGHTS

- Redevelopment & Value-Add Play (Way Below Market Rents).

- Fully Occupied Retail Center Near-Term Lease Expirations.

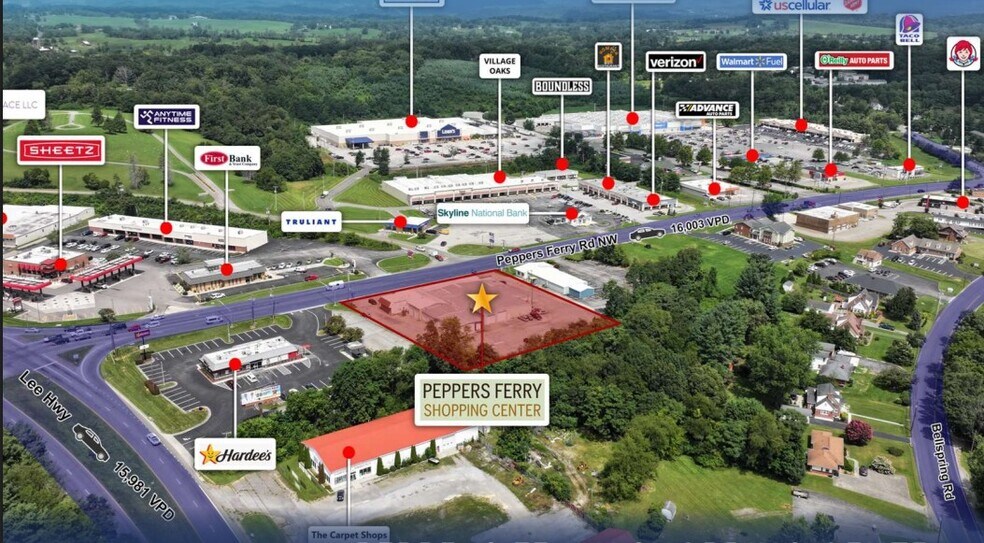

- Directly Across from Lowe's and Walmart Supercenters.

- Investment Grade Anchor Tenant, Recent Capital Improvements.

EXECUTIVE SUMMARY

Fortis Net Lease is pleased to present the opportunity to acquire the Peppers Ferry Shopping Center, a 100% occupied, five-unit retail property located along Route 114 in Fairlawn, Virginia. Totaling 18,601 square feet, the center combines stable in-place cash flow with immediate and long-term value creation potential through strategic lease-up,

rent resets, and redevelopment.

The property has been well maintained, with more than $36,000 invested in roof repairs in 2024, ensuring minimal near-term capital expenditures for a new owner. While the property currently produces a total annual rent of $106,435 (or just $5.72 per SF), this figure is significantly below market for comparable retail in the Radford/Fairlawn trade area. This creates a compelling opportunity to acquire a stabilized asset at an attractive basis, with strong upside upon lease rollover or re-tenanting.

The center features a diverse tenant roster anchored by Flowers Baking Co. of Jamestown, LLC, a publicly traded, investment-grade operator with a long-standing presence at the property. Additional tenants include Dublin Pawn, Iron for Zion, Tobacco Hut, and a garage tenant operating on a month-to-month lease. Several tenants are paying dramatically below-market rents, including Iron for Zion at just $4.15 per SF and the garage tenant at only $0.78 per SF — providing significant room to increase NOI upon renewal or replacement.

Near-term expirations further enhance the value-add profile. Leases for Iron for Zion and Dublin Pawn both expire in March 2026, while the garage tenant is already on a

holdover basis. This creates flexibility for a new owner to either renew at market rents, reposition the space for higher and better use, or redevelop portions of the center to attract stronger tenants and drive future appreciation.

Also, in-place cash flow provides immediate stability, anchored by Flowers Baking Co. through September 2026 and Tobacco Hut through July 2028. These tenants generate more than one-third of the current rental income, balancing redevelopment flexibility with secure national and regional tenancy

rent resets, and redevelopment.

The property has been well maintained, with more than $36,000 invested in roof repairs in 2024, ensuring minimal near-term capital expenditures for a new owner. While the property currently produces a total annual rent of $106,435 (or just $5.72 per SF), this figure is significantly below market for comparable retail in the Radford/Fairlawn trade area. This creates a compelling opportunity to acquire a stabilized asset at an attractive basis, with strong upside upon lease rollover or re-tenanting.

The center features a diverse tenant roster anchored by Flowers Baking Co. of Jamestown, LLC, a publicly traded, investment-grade operator with a long-standing presence at the property. Additional tenants include Dublin Pawn, Iron for Zion, Tobacco Hut, and a garage tenant operating on a month-to-month lease. Several tenants are paying dramatically below-market rents, including Iron for Zion at just $4.15 per SF and the garage tenant at only $0.78 per SF — providing significant room to increase NOI upon renewal or replacement.

Near-term expirations further enhance the value-add profile. Leases for Iron for Zion and Dublin Pawn both expire in March 2026, while the garage tenant is already on a

holdover basis. This creates flexibility for a new owner to either renew at market rents, reposition the space for higher and better use, or redevelop portions of the center to attract stronger tenants and drive future appreciation.

Also, in-place cash flow provides immediate stability, anchored by Flowers Baking Co. through September 2026 and Tobacco Hut through July 2028. These tenants generate more than one-third of the current rental income, balancing redevelopment flexibility with secure national and regional tenancy

PROPERTY FACTS

Sale Type

Investment

Sale Condition

Redevelopment Project

Property Type

Retail

Building Size

18,601 SF

Building Class

C

Year Built

1968

Price

$1,736,420 CAD

Price Per SF

$93.35 CAD

Cap Rate

7%

NOI

$121,504 CAD

Percent Leased

100%

Tenancy

Multiple

Building Height

1 Story

Building FAR

0.17

Lot Size

2.51 AC

Zoning

CM1 - Commercial

PROPERTY TAXES

| Parcel Number | 17700 | Improvements Assessment | $269,588 CAD |

| Land Assessment | $734,937 CAD | Total Assessment | $1,004,525 CAD |

PROPERTY TAXES

Parcel Number

17700

Land Assessment

$734,937 CAD

Improvements Assessment

$269,588 CAD

Total Assessment

$1,004,525 CAD

1 of 12

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP