Log In/Sign Up

Your email has been sent.

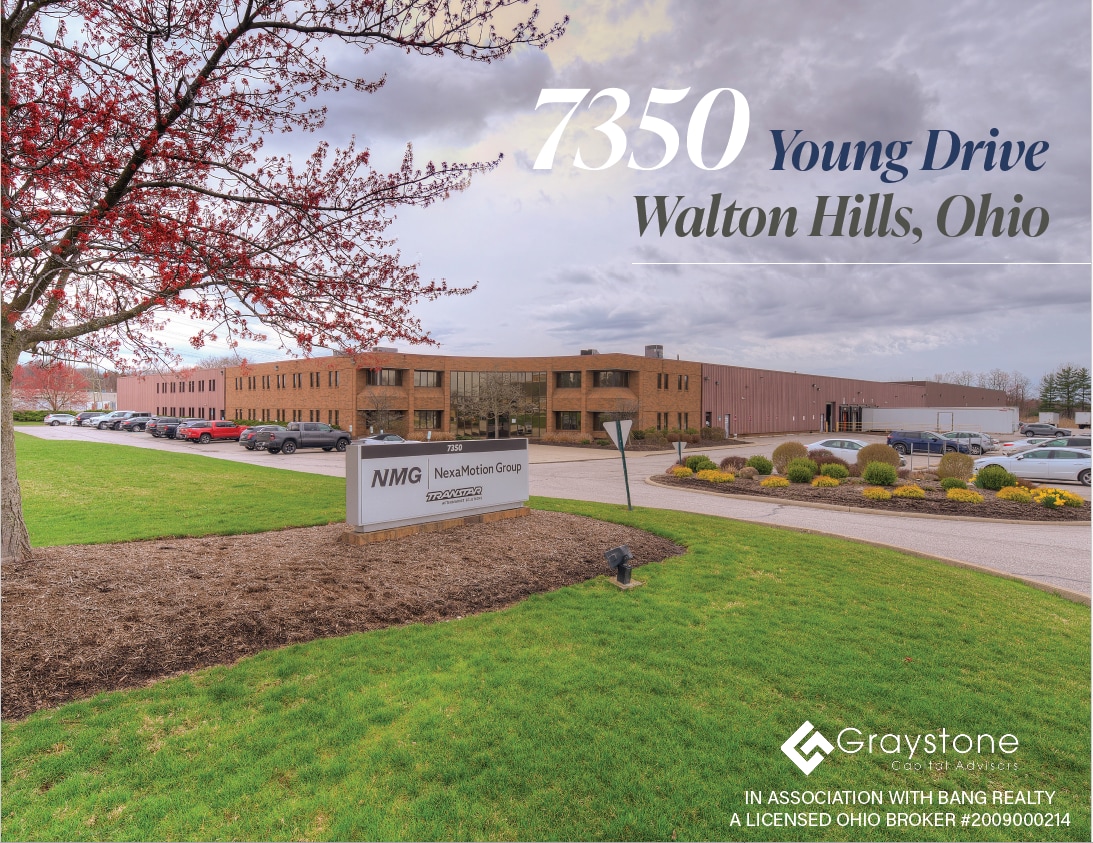

7350 Young Dr

Walton Hills, OH 44146

Transtar Industries · Industrial Property For Sale

INVESTMENT HIGHLIGHTS

- Well-Located Industrial Asset: ±142,016 SF With 18’&22' Clear Heights, Dock-High Loading, Cleveland MSA

- 60% of Roof Replaced in 2023

- Short-Term Yield: In-Place Rent Provides a 10.24% Cap Rate Through January 2027

- Options for Re-Lease, Repositioning, or Owner-User at Lease Expiration

- Additional 2.65 AC available

EXECUTIVE SUMMARY

Graystone Capital Advisors is pleased to present the opportunity to acquire a high-yield, short-term industrial investment in Walton Hills, Ohio.

Built in 1985 and expanded in 2000, the property offers 142,016 SF with 17,992 SF of two story office and 124,024 SF of warehouse space on 9.19 acres zoned IG. The building includes 18 & 22 foot clear height, block and metal construction, full sprinkler coverage, 8 dock high doors, and 2 drive in doors, providing efficient functionality for a range of industrial uses.

Located in a strong Cleveland industrial market with a 3.7 percent vacancy rate in Q3 2025, the region benefits from steady demand, a diverse manufacturing base, and excellent transportation access.

At lease maturity, buyers can reposition the asset by re leasing at market rates, subdividing for multiple tenants, or occupying the property as an owner user.

The in-place rent of $998,537 delivers an outsized return with a 10.24% cap rate. At lease maturity, buyers

can reposition the asset: re-lease at market rates, subdivide for multiple tenants, or occupy the property as an

owner-user.

Built in 1985 and expanded in 2000, the property offers 142,016 SF with 17,992 SF of two story office and 124,024 SF of warehouse space on 9.19 acres zoned IG. The building includes 18 & 22 foot clear height, block and metal construction, full sprinkler coverage, 8 dock high doors, and 2 drive in doors, providing efficient functionality for a range of industrial uses.

Located in a strong Cleveland industrial market with a 3.7 percent vacancy rate in Q3 2025, the region benefits from steady demand, a diverse manufacturing base, and excellent transportation access.

At lease maturity, buyers can reposition the asset by re leasing at market rates, subdividing for multiple tenants, or occupying the property as an owner user.

The in-place rent of $998,537 delivers an outsized return with a 10.24% cap rate. At lease maturity, buyers

can reposition the asset: re-lease at market rates, subdivide for multiple tenants, or occupy the property as an

owner-user.

PROPERTY FACTS

PROPERTY TAXES

| Parcel Number | 794-28-008 | Improvements Assessment | $2,202,002 CAD |

| Land Assessment | $336,137 CAD | Total Assessment | $2,538,139 CAD |

PROPERTY TAXES

Parcel Number

794-28-008

Land Assessment

$336,137 CAD

Improvements Assessment

$2,202,002 CAD

Total Assessment

$2,538,139 CAD

1 of 7

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP