Your email has been sent.

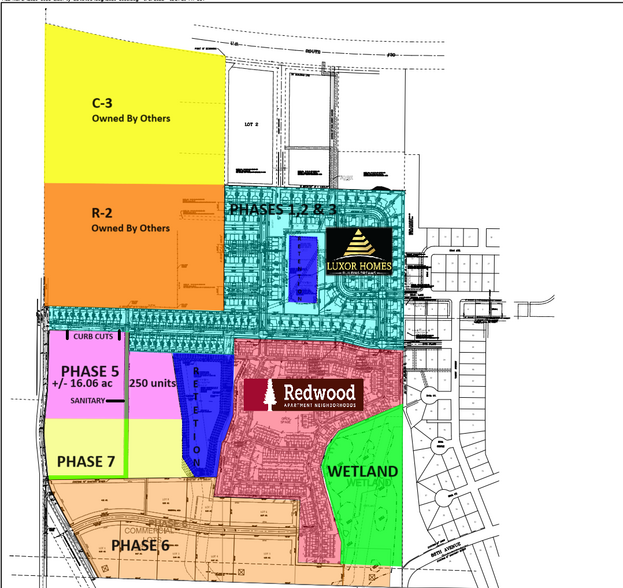

8415 Whitcomb St - Phases 5 & 7 500 Apartments Approved 36 Acres of Residential Land Offered at $11,961,688 CAD in Merrillville, IN 46410

Investment Highlights

- Fully Approved

- Utilities to Site

- No Known Offsite Improvements Required

- Offsite Retention

- 500 Total Units Approved

- Aggressively Growing Market

Executive Summary

The Lake County market is severely under served in respect to new, market rate, multifamily offerings as the average product is vintage 1990’s - early 2000’s. This is primarily due to municipal restrictions placed on such development within south Lake County, which has created a high barrier to entry.

Indiana Senate Bill 1 (SB 1), enacted in April 2025, is a comprehensive local government finance reform package aimed at providing property tax relief, enhancing transparency, and restructuring local income taxes (LIT). Sponsored by Sen. Travis Holdman and Rep. Jeff Thompson, it primarily targets homeowner relief—saving an estimated $1.3 billion for Hoosier homeowners—while introducing new deductions for other property classes, expanding business personal property tax (BPPT) exemptions, and imposing limits on future tax hikes. The bill shifts some tax burdens from residential to commercial properties but includes targeted relief for non-homestead residential and agricultural lands. Key changes phase in over several years to ease implementation.

New Phased-In Deduction on Assessed Value: SB1 creates a deduction specifically for properties in the 2% tax cap category, which includes apartments and other rental/multi-family residential properties. This deduction reduces the net assessed value (gross assessed value minus deductions) used to calculate property taxes, directly lowering the tax bill for owners.

The deduction phases in gradually over several years:

6% in 2026

12% in 2027

19% in 2028

25% in 2029

30% in 2030–2031

33% (one-third) in 2032 and every year thereafter

**THIS IS NOT TAX ADVICE. CONSULT YOUR TAX PROFESSIONALS EXPERIENCED IN INDIANA PROPERTY TAXES TO CONFIRM.**

SEE OM FOR FURTHER DETAIL

Property Facts

| Price | $11,961,688 CAD | Property Subtype | Residential |

| Sale Type | Investment | Proposed Use | |

| No. Lots | 1 | Total Lot Size | 36.00 AC |

| Property Type | Land | ||

| Zoning | PUD - Planned Unit Development. | ||

| Price | $11,961,688 CAD |

| Sale Type | Investment |

| No. Lots | 1 |

| Property Type | Land |

| Property Subtype | Residential |

| Proposed Use | |

| Total Lot Size | 36.00 AC |

| Zoning | PUD - Planned Unit Development. |

1 Lot Available

Lot 5 & 7

| Price | $11,961,688 CAD | Lot Size | 36.00 AC |

| Price Per AC | $332,269.11 CAD |

| Price | $11,961,688 CAD |

| Price Per AC | $332,269.11 CAD |

| Lot Size | 36.00 AC |

Description

1. Fully approved with Developer engineering available 2. Phases 5 & 7: +/- 36 Acres 3. PUD approval in place for 500 total units 4. No On-site Park Requirements 5. No known off-site Expense to Buyer 6. Luxor Homes, Inc is the residential home builder in Phases 1, 2 & 3 with single family homes ranging in the $400 - $500’s 7. 20 acre regional park across Whitcomb Street 8. Low Real Estate Taxes (Capped at 2%; excluding referendum items) 9. Aggressively Growing South Chicago Suburban Market 10. Attractive School System 11. All Utilities installed to, or adjacent to, site 12. Adjacent to 17.7 mile regional Erie Lackawanna Trail 13. Luxor has over 60 residential units under roof expects to complete its build-out Phases 1, 2 & 3 in 2026 14. Whitcomb Street is being improved in to serve as a regional corridor. The improvements include a round-a-bout to serve Liberty Estates Phases 5 & 7. The project is expected to be completed in 2026 / 2027

Property Taxes

| Parcel Number | 45-12-19-451-004.000-030 | Improvements Assessment | $0 CAD |

| Land Assessment | $16,815 CAD | Total Assessment | $16,815 CAD |

Property Taxes

Presented by

8415 Whitcomb St - Phases 5 & 7 500 Apartments Approved

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.