Log In/Sign Up

Your email has been sent.

Investment Highlights

- Land is lasered, and all the pieces are in place for large-scale technology, AI, and data center development to begin in Q1 2026.

- Impeccable positioning atop the Alpine High Gas zone, a 5,000-foot thick natural gas zone, ranked by Britannica as a global Supergiant field.

- Gas transport company will sign a contract for 10+ years, with firm transport, and the gas capacity will be ready after the 6-month meter built out.

- Averaging $2.00 or less per MMBTU (= under $0.02 per kWh), WAHA index gas is among the cheapest in the United States.

- Emissions are covered with SCR systems in place to reduce NOx to under 9 PPM, qualifying for Texas's expedited TCEQ permitting (60 to 90 days).

- Area is poised to become a global energy capital and is expected to be one of the largest energy sectors in the world within the next five years.

Executive Summary

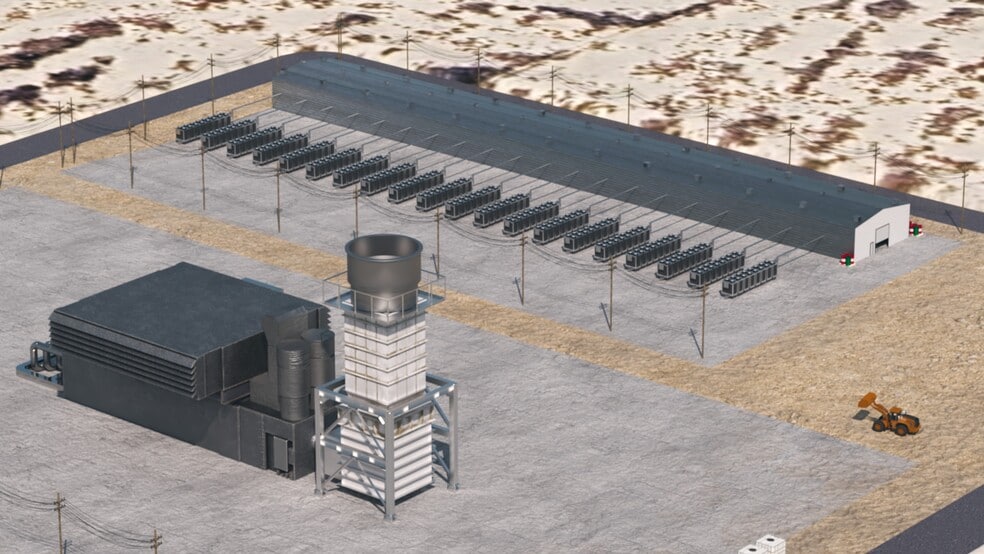

Rare, 2.4-gigawatt energy campus that is development-ready, offering immediate access to gas turbines and genset packages. The seller's family business, a global power generation firm, provides direct access to aeroderivative genset packages and over a gigawatt of used and new turbines for immediate sale, with Phase 1 (240 MW) deployable by Q4 2026. Installation, operations support, and maintenance can be provided for all genset packages.

Two 36-inch natural gas pipelines (Kinetic & OneOk) cross the parcel, each with a capacity of 1.7 BCF. After nearly a year, the seller has a gas term sheet in hand stating the WAHA index plus a 40-cent transport fee for up to 400,000 MMBTU of gas. Two gas meters will be installed, each with a 200,000 MMBTU capacity, or approximately 1,200 MW of electrical capacity each (2.4 gigawatts total). The seller will wire $4,000,000 on November 12, 2026, to construct the first gas meter, which is expected to take 140 to 170 days to complete and be ready for gas turbine hook-up.

The seller's family-owned enterprise operates power plants and turbine generation facilities in over 37 countries, with nearly 1,000 people employed globally. The average cost to operate turbines ranges from 0.5 to 1.5 cents per kw/h, depending on the O&M tier package the owner desires, and can also be handled by the family business if the buyer chooses. The enterprise's headquarters is in Corpus Christi, Texas, making operations on this Pecos, Texas, site even more ideal, as it is only hours away. With six 50-ton overhead cranes at their Corpus Christi headquarters, the family business also handles all aspects of turbine and engine refurbishment, except for a 50,000-hour major overhaul, typically only performed by the OEM.

Relationships with SCR manufacturing companies are in place so that all turbines purchased and deployed will have proper SCR exhaust add-ons to reduce the NOX PPM down from 25 PPM to 5-8PPM. This allows for an expedited fast-track permitting process with the TCEQ, which is nearly automatic, and enables buyers to start construction within a matter of a few months. Four commercial water wells (two active) on-site produce 3,000 gallons per minute, and a long-haul fiber line with dark fiber available lies 4.5 miles north.

Grid interconnect is underway via Vega. Buyer may opt for a grid-tied or private Behind-the-Meter setup. A 765-kV transmission line, known as the Big Hill to Sand Lake 765-kV Transmission Line Project, is expected to be approved early in 2026, with completion anticipated between 2029 and 2030. Additionally, Microsoft's $14 billion energy campus with Nscale is just 15 minutes East.

Few companies have begun drilling in the Alpine High zone because there is already an abundance of excess gas coming from other major zones in the Permian Basin. Again, just another example of why this area is positioned to be a superior location for AI and other hyperscale companies.

The seller has agreed to pay a 7% commission to the buyer's broker/agent. The family's global enterprise is willing to consider an exclusive agreement with the buyer of this deal for all turbines in the pipeline, provided the logistics are feasible. The sellers are not interested in selling turbines alone. The family enterprise can guarantee 2,400 MW of turbine capacity by 2029 with ramp-up phases between now and then.

Pricing: Make Offer – All reasonable offers will be considered

Serious inquiries only. No wholesalers. This is a large project with incredible long-term scalability. A 12% non-refundable deposit is required for any contract feasibility period. The seller is willing to accept Cash, Bitcoin, or stock options as payment, depending on the buyer and the structure.

Two 36-inch natural gas pipelines (Kinetic & OneOk) cross the parcel, each with a capacity of 1.7 BCF. After nearly a year, the seller has a gas term sheet in hand stating the WAHA index plus a 40-cent transport fee for up to 400,000 MMBTU of gas. Two gas meters will be installed, each with a 200,000 MMBTU capacity, or approximately 1,200 MW of electrical capacity each (2.4 gigawatts total). The seller will wire $4,000,000 on November 12, 2026, to construct the first gas meter, which is expected to take 140 to 170 days to complete and be ready for gas turbine hook-up.

The seller's family-owned enterprise operates power plants and turbine generation facilities in over 37 countries, with nearly 1,000 people employed globally. The average cost to operate turbines ranges from 0.5 to 1.5 cents per kw/h, depending on the O&M tier package the owner desires, and can also be handled by the family business if the buyer chooses. The enterprise's headquarters is in Corpus Christi, Texas, making operations on this Pecos, Texas, site even more ideal, as it is only hours away. With six 50-ton overhead cranes at their Corpus Christi headquarters, the family business also handles all aspects of turbine and engine refurbishment, except for a 50,000-hour major overhaul, typically only performed by the OEM.

Relationships with SCR manufacturing companies are in place so that all turbines purchased and deployed will have proper SCR exhaust add-ons to reduce the NOX PPM down from 25 PPM to 5-8PPM. This allows for an expedited fast-track permitting process with the TCEQ, which is nearly automatic, and enables buyers to start construction within a matter of a few months. Four commercial water wells (two active) on-site produce 3,000 gallons per minute, and a long-haul fiber line with dark fiber available lies 4.5 miles north.

Grid interconnect is underway via Vega. Buyer may opt for a grid-tied or private Behind-the-Meter setup. A 765-kV transmission line, known as the Big Hill to Sand Lake 765-kV Transmission Line Project, is expected to be approved early in 2026, with completion anticipated between 2029 and 2030. Additionally, Microsoft's $14 billion energy campus with Nscale is just 15 minutes East.

Few companies have begun drilling in the Alpine High zone because there is already an abundance of excess gas coming from other major zones in the Permian Basin. Again, just another example of why this area is positioned to be a superior location for AI and other hyperscale companies.

The seller has agreed to pay a 7% commission to the buyer's broker/agent. The family's global enterprise is willing to consider an exclusive agreement with the buyer of this deal for all turbines in the pipeline, provided the logistics are feasible. The sellers are not interested in selling turbines alone. The family enterprise can guarantee 2,400 MW of turbine capacity by 2029 with ramp-up phases between now and then.

Pricing: Make Offer – All reasonable offers will be considered

Serious inquiries only. No wholesalers. This is a large project with incredible long-term scalability. A 12% non-refundable deposit is required for any contract feasibility period. The seller is willing to accept Cash, Bitcoin, or stock options as payment, depending on the buyer and the structure.

Property Facts

1 Lot Available

Lot

| Lot Size | 770.00 AC |

| Lot Size | 770.00 AC |

Rare, 2.4-gigawatt energy campus that is development-ready, offering immediate access to gas turbines and genset packages.

Demographics

Regional Accessibility

City

Population

Miles

Drive Time

El Paso

682,669

203

3 h 19 m

San Antonio

1,532,233

360

5 h 58 m

Austin

964,254

392

6 h 52 m

Fort Worth

895,008

398

6 h 51 m

Dallas

1,345,047

438

7 h 39 m

Houston

2,325,502

570

9 h 44 m

Access and Labor Force

10 Miles

Total Population

13,634

Total Labor Force

5,640

Unemployment Rate

3.19%

Median Household Income

$56,210

Warehouse Employees

1,037

High School Education Or Higher

73.80%

$ values in USD

Nearby Amenities

Restaurants |

|||

|---|---|---|---|

| Subway | - | - | 8 min walk |

| Domino’s | - | - | 12 min walk |

Retail |

||

|---|---|---|

| Tractor Supply Company | Home Improvement | 7 min walk |

Hotels |

|

|---|---|

| Hampton by Hilton |

64 rooms

2 min drive

|

| Red Roof Inn |

36 rooms

2 min drive

|

| Best Western Plus |

105 rooms

3 min drive

|

| Comfort Suites |

58 rooms

4 min drive

|

| Fairfield Inn |

87 rooms

4 min drive

|

Sale Advisor

Richard Lowrance, Seller Representative

Richard Lowrance is one of the founding members of PropertyCashin. For over five years, he has concentrated on commercial real estate, with a strong emphasis on data and infrastructure development. Their main markets are Dallas/Fort Worth, Houston, San Antonio, and the Los Angeles area.

1 of 7

Videos

Matterport 3D Exterior

Matterport 3D Tour

Photos

Street View

Street

Map

Presented by

Highway 17

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.