Log In/Sign Up

Your email has been sent.

Retail Portfolio | Lakeview Commons 2 Retail Properties Offered at $3,101,625 CAD in Southaven, MS

INVESTMENT HIGHLIGHTS

- Scarcity of Stabilized, Cash-Flowing Assets in 38671

- Strong Corner Location with High Visibility | Prime Demographics & Daytime Demand

- Capital Market Conditions: Interest Rates Shift Buyer Preferences | Cost Segregation Opportunity Enhances After-Tax Returns

- New Construction + Recent Capital Improvements

- Strong Blend of Longstanding and Newer Tenants Supports Stability | Below-Market Rents Create Future Upside Potential

- Priced Below Replacement Cost | Long-Term Appreciation Potential

EXECUTIVE SUMMARY

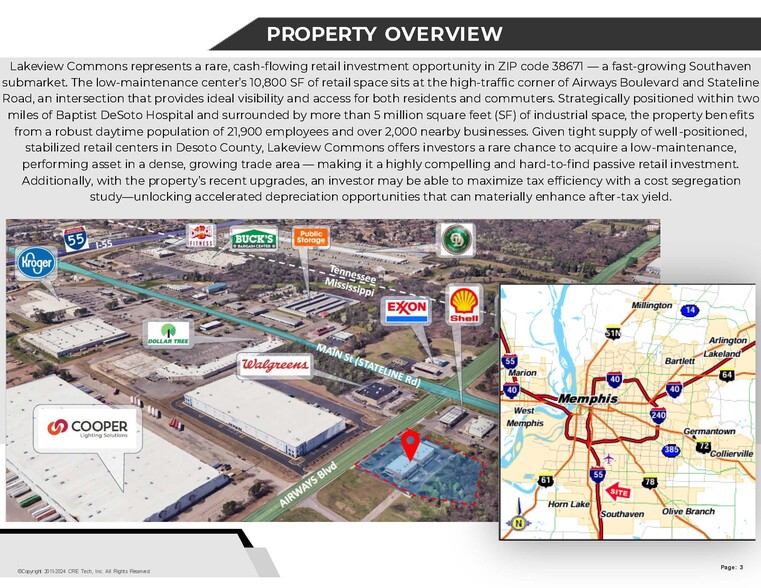

Lakeview Commons represents a rare, cash-flowing retail investment opportunity in ZIP code 38671 — a fast-growing Southaven submarket. The low-maintenance center’s 10,800 SF of retail space sits at the high-traffic corner of Airways Boulevard and Stateline Road, an intersection that provides ideal visibility and access for both residents and commuters. Strategically positioned within two miles of Baptist DeSoto Hospital and surrounded by more than 5 million square feet (SF) of industrial space, the property benefits from a robust daytime population of 21,900 employees and over 2,000 nearby businesses. Given tight supply of well-positioned, stabilized retail centers in Desoto County, Lakeview Commons offers investors a rare chance to acquire a low-maintenance, performing asset in a dense, growing trade area — making it a highly compelling and hard-to-find passive retail investment. Additionally, with the property’s recent upgrades, an investor may be able to maximize tax efficiency with a cost segregation study—unlocking accelerated depreciation opportunities that can materially enhance after-tax yield.

10 Reasons Why This is a Great Investment

1. Scarcity of Stabilized, Cash-Flowing Assets in 38671

• Very few "turnkey," newer construction assets trade in this submarket.

• Most inventory at 9% caps involves older roofs, aging parking lots, legacy HVAC, or vacancy risk.

• Lakeview Commons is fully stabilized and performing, which commands pricing premium.

?

2. New Construction + Recent Capital Improvements

• Recently upgraded parking lot, HVAC systems, and demising work.

• Lower near-term capital expenditure needs = reduced operational risk.

• Investors typically pay tighter caps for assets requiring minimal upfront CapEx.

?

3. Strong Corner Location with High Visibility

• Hard corner at Airways & Stateline with heavy traffic counts.

• Superior visibility and access compared to comparable centers.

• Better corners trade at better caps.

?

4. Prime Demographics & Daytime Demand

• ZIP 38671 demographics outperform many suburban retail markets:

• Population density: 1,600+ people per sq mile

• Median household income: ~$61,700

• Strong daytime population from hospital + industrial corridor

• Supports daily-needs retail and minimizes occupancy volatility.

?

5. Capital Market Conditions: Interest Rates Shift Buyer Preferences

• Elevated commercial interest rates have pushed distressed or aging centers to 9% caps or higher.

• Newer, stable, low-maintenance assets like Lakeview Commons compress in cap rate because they reduce financing risk and income volatility.

• Investors are prioritizing long-term stability and predictable NOI in high-rate cycles.

?

6. Cost Segregation Opportunity Enhances After-Tax Returns

• Recent capital improvements make the property a strong candidate for a buyer-initiated cost segregation study.

• Potential for accelerated depreciation on:

• New HVAC units

• Parking improvements

• Interior build-out / demising elements

Effective after-tax yield may outperform the stated 7.32% return, strengthening the economic rationale for the pricing.

?

7. Priced Below Replacement Cost

• Rising construction costs (labor, materials, site work) make reproducing this asset significantly more expensive today.

• Buying below replacement cost justifies tighter cap rates and supports long-term value retention.

?

8. Long-Term Appreciation Potential

• Hard-corner, high-traffic retail sites historically outperform the broader retail market.

• Limited availability of future comparable development sites.

• Better exit strategy = stronger pricing power today.

?

9. Strong Blend of Longstanding and Newer Tenants Supports Stability

• A healthy mix of long-term occupants (some in place since 2008, 2010, 2015) combined with newer service-based tenants, have recently signed multi-year leases.

• This blend reduces rollover risk while also keeping the center dynamic and relevant to the trade area.

• The stability of long-term tenants paired with the momentum of new leases supports low vacancy risk in the near and mid-term.

?

10. Below-Market Rents Create Future Upside Potential

• Several existing tenants—especially those with long occupancy histories—are paying below current market rental rates.

• This presents a clear opportunity to capture rental uplift at renewal or during option negotiations.

• The ability to gradually move rents to market over time enhances long-term NOI growth, supporting the property’s premium pricing.

IMPORTANT NOTE: PLEASE DO NOT DISTURB CURRENT TENANTS; DRIVE BY ONLY.

10 Reasons Why This is a Great Investment

1. Scarcity of Stabilized, Cash-Flowing Assets in 38671

• Very few "turnkey," newer construction assets trade in this submarket.

• Most inventory at 9% caps involves older roofs, aging parking lots, legacy HVAC, or vacancy risk.

• Lakeview Commons is fully stabilized and performing, which commands pricing premium.

?

2. New Construction + Recent Capital Improvements

• Recently upgraded parking lot, HVAC systems, and demising work.

• Lower near-term capital expenditure needs = reduced operational risk.

• Investors typically pay tighter caps for assets requiring minimal upfront CapEx.

?

3. Strong Corner Location with High Visibility

• Hard corner at Airways & Stateline with heavy traffic counts.

• Superior visibility and access compared to comparable centers.

• Better corners trade at better caps.

?

4. Prime Demographics & Daytime Demand

• ZIP 38671 demographics outperform many suburban retail markets:

• Population density: 1,600+ people per sq mile

• Median household income: ~$61,700

• Strong daytime population from hospital + industrial corridor

• Supports daily-needs retail and minimizes occupancy volatility.

?

5. Capital Market Conditions: Interest Rates Shift Buyer Preferences

• Elevated commercial interest rates have pushed distressed or aging centers to 9% caps or higher.

• Newer, stable, low-maintenance assets like Lakeview Commons compress in cap rate because they reduce financing risk and income volatility.

• Investors are prioritizing long-term stability and predictable NOI in high-rate cycles.

?

6. Cost Segregation Opportunity Enhances After-Tax Returns

• Recent capital improvements make the property a strong candidate for a buyer-initiated cost segregation study.

• Potential for accelerated depreciation on:

• New HVAC units

• Parking improvements

• Interior build-out / demising elements

Effective after-tax yield may outperform the stated 7.32% return, strengthening the economic rationale for the pricing.

?

7. Priced Below Replacement Cost

• Rising construction costs (labor, materials, site work) make reproducing this asset significantly more expensive today.

• Buying below replacement cost justifies tighter cap rates and supports long-term value retention.

?

8. Long-Term Appreciation Potential

• Hard-corner, high-traffic retail sites historically outperform the broader retail market.

• Limited availability of future comparable development sites.

• Better exit strategy = stronger pricing power today.

?

9. Strong Blend of Longstanding and Newer Tenants Supports Stability

• A healthy mix of long-term occupants (some in place since 2008, 2010, 2015) combined with newer service-based tenants, have recently signed multi-year leases.

• This blend reduces rollover risk while also keeping the center dynamic and relevant to the trade area.

• The stability of long-term tenants paired with the momentum of new leases supports low vacancy risk in the near and mid-term.

?

10. Below-Market Rents Create Future Upside Potential

• Several existing tenants—especially those with long occupancy histories—are paying below current market rental rates.

• This presents a clear opportunity to capture rental uplift at renewal or during option negotiations.

• The ability to gradually move rents to market over time enhances long-term NOI growth, supporting the property’s premium pricing.

IMPORTANT NOTE: PLEASE DO NOT DISTURB CURRENT TENANTS; DRIVE BY ONLY.

PROPERTY FACTS

| Price | $3,101,625 CAD | Number of Properties | 2 |

| Price / SF | $287.19 CAD / SF | Individually For Sale | 0 |

| Cap Rate | 7.32% | Total Building Size | 10,800 SF |

| Sale Type | Investment NNN | Total Land Area | 2.27 AC |

| Status | Active |

| Price | $3,101,625 CAD |

| Price / SF | $287.19 CAD / SF |

| Cap Rate | 7.32% |

| Sale Type | Investment NNN |

| Status | Active |

| Number of Properties | 2 |

| Individually For Sale | 0 |

| Total Building Size | 10,800 SF |

| Total Land Area | 2.27 AC |

PROPERTIES

| PROPERTY NAME / ADDRESS | PROPERTY TYPE | SIZE | YEAR BUILT | INDIVIDUAL PRICE |

|---|---|---|---|---|

| 8946 Airways Blvd, Southaven, MS 38671 | Retail | 5,400 SF | 2007 | - |

| 8936 Airways Blvd, Southaven, MS 38671 | Retail | 5,400 SF | 2008 | - |

1 1

1 of 5

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

Retail Portfolio | Lakeview Commons

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.