Debt Service Coverage Ratio (DSCR) Explained for Canadian Investors

Article Summary

- DSCR measures whether a property's net operating income (NOI) is sufficient to cover its annual loan payments.

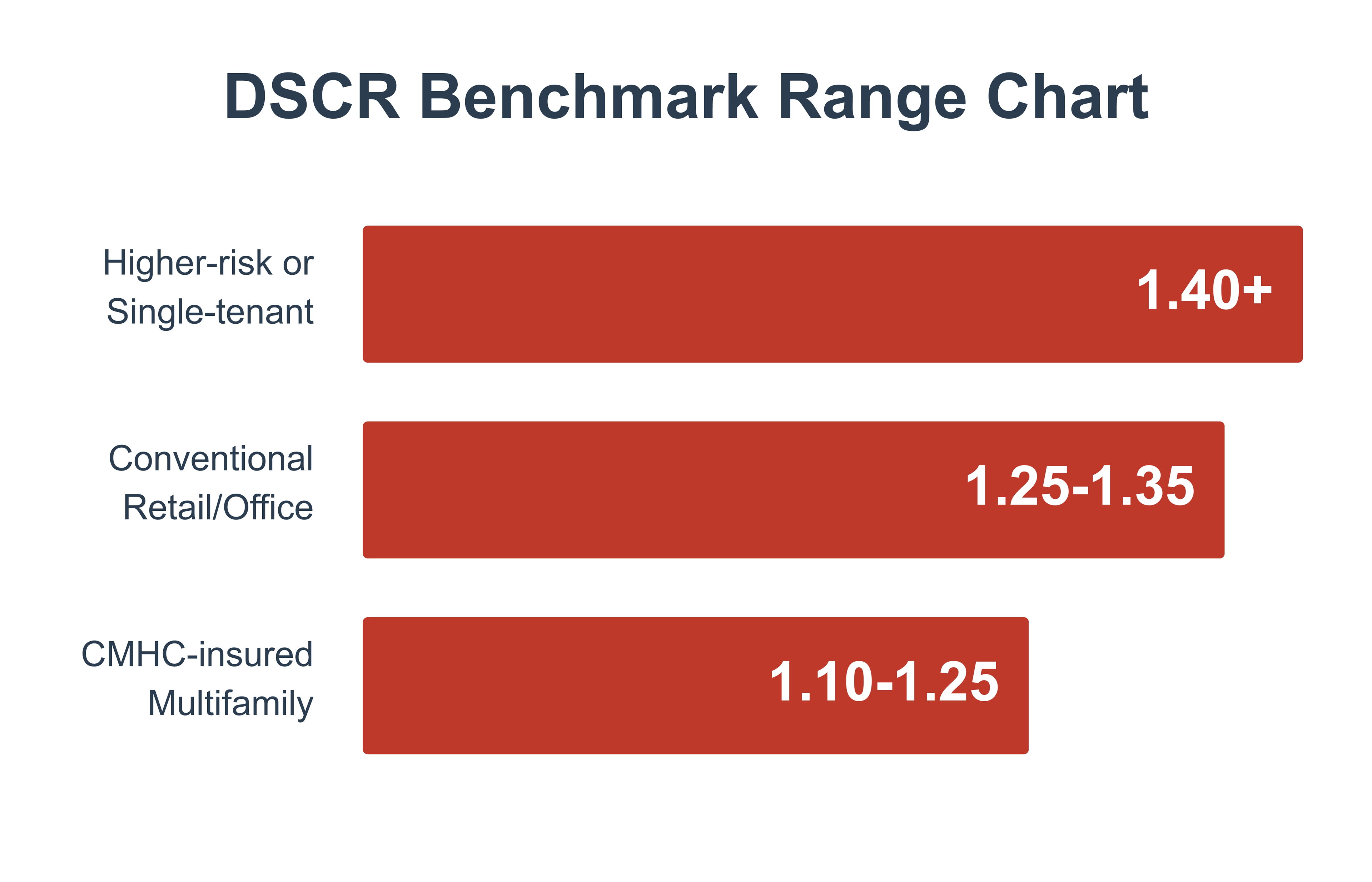

- Typical benchmarks range from 1.10-1.25 for multifamily properties insured by the Canada Mortgage and Housing Corporation (CMHC), and 1.25-1.40+ for conventional retail, office, or mixed-use assets.

- A higher DSCR signals stronger cash flow and lower risk, often leading to better interest rates and loan flexibility.

- Evaluate DSCR alongside loan-to-value (LTV), cap rate, and cash-on-cash return for a complete picture of performance.

What Is the Debt Service Coverage Ratio (DSCR)?

DSCR shows how comfortably a property's income covers its annual loan payments.

Before you approach a lender for your first commercial property loan, there's one number they'll scrutinize more than any other: Debt Service Coverage Ratio. Get it wrong, and you could face rejection or unfavorable terms. Get it right, and you'll unlock better rates and higher leverage.

For investors, DSCR is one of the simplest ways to measure how much breathing room a property has between income and debt. It tells you how many dollars of net operating income (NOI) are earned for every dollar of annual mortgage payments.

The formula is straightforward: DSCR = NOI ÷ Total Debt Service, where total debt service includes annual principal and interest payments.

If a property earns $120,000 in NOI and pays $100,000 in annual mortgage costs, its DSCR is 1.20, meaning it generates 20% more income than required to service the debt. Ratios below 1.0 mean income does not fully cover payments.

Canadian lenders use DSCR to assess loan strength and risk, giving both borrowers and underwriters a clear measure of stability. Think about it like this: A strong DSCR reassures lenders that the property can cover its debt and helps investors gauge whether a deal is financially stable.

How Do You Calculate DSCR?

Divide annual net operating income by total annual debt payments.

The math is simple, but what matters is how you interpret it. A DSCR of 1.00 means income exactly covers loan payments, and anything above 1.00 indicates additional income beyond debt requirements. A property with a DSCR of 1.30, for example, is expected to generate 30% more income than required to meet its debt services. Typically, anything above 1.20 signals a healthy buffer. The higher the ratio, the more comfortably a property can service its debt.

You can use this calculation to compare financing options or stress-test a property before applying for a loan. Even small changes in rent, interest rates, or amortisation (the length of time you take to repay the loan) periods can shift your DSCR enough to affect loan eligibility and long-term returns.

Want to see your own numbers? Use our DSCR Calculator below to test different income and loan scenarios. You can adjust figures in real time to explore how rental income, interest rate, or loan size affect your ratio.

Try entering your property’s net operating income and annual loan payments to find out how comfortably it covers its debt service. The tool updates automatically as you change values, helping you visualise where your investment stands before you meet with a lender.

Once you’ve checked your results, scroll down to learn how Canadian lenders interpret DSCR ranges and what a strong ratio means for your financing options.

Debt Service Coverage Ratio (DSCR) Calculator

Debt Service Coverage Ratio (DSCR) Calculator

What Factors Influence DSCR?

Income, expenses, and financing terms all play a role.

- Income growth: Higher rents, stable occupancy, and reliable tenants all increase DSCR.

- Operating costs: Taxes, maintenance, and insurance can erode NOI if left unchecked.

- Financing terms: Lower interest or longer amortisation periods reduce annual payments and raise DSCR.

Vacancy levels, tenant turnover, and the type of lease in place can all shift your ratio quickly. Understanding how different commercial lease types allocate expenses helps you see how operating costs flow into your DSCR calculations. Monitoring these factors and testing “what-if” scenarios will help you plan ahead.

These factors also relate to how different commercial sectors behave within Canada's market. For instance, industrial properties often show stronger DSCR stability because of long leases and limited supply.

Why Does DSCR Matter in Commercial Real Estate?

Lenders rely on DSCR to gauge risk and set loan terms.

DSCR is one of the first numbers an underwriter will review to assess risk and determine loan eligibility. A DSCR above 1.25 can help secure lower rates, higher leverage, and smoother approvals. Knowing your ratio early lets you stress-test cash flow, avoid surprises, and plan financing that holds up through market shifts.

CMHC's multi-unit programmes often require 1.10-1.25, while most conventional lenders look for 1.25-1.40, depending on property type and tenant quality.

Here's what's at stake: if your DSCR falls short of lender requirements, you might have to put down a larger deposit, accept higher interest rates, or watch the property you wanted go to another buyer. For first-time investors, knowing your DSCR before you apply eliminates these surprises and puts you in control of the negotiation.

What Is Considered a Good DSCR in Canada?

A DSCR between 1.20 and 1.40 is generally considered healthy.

Lenders favour higher DSCRs because they suggest stable income and lower risk. Many investors apply this ratio when assessing properties for sale in Toronto or commercial listings in Vancouver, where pricing and demand differ by sector.

A CMHC-insured multifamily property may qualify with 1.10-1.25, while retail, office, or industrial properties usually need 1.25-1.35. Higher-risk or single-tenant assets may require 1.40 or more.

The chart below shows how typical DSCR ranges vary across common property and lender types in Canada.

If your current DSCR sits below 1.20, don't panic. Many first-time investors start here. The key is knowing where you stand so you can make informed decisions about which properties to pursue and how much leverage you can responsibly handle.

What counts as a “good” DSCR depends on your goals. Growth-focused investors may accept tighter margins, while those seeking stable income usually prefer a stronger buffer.

How Does DSCR Affect Loan Approval and Leverage?

Your DSCR can determine how much you can borrow and whether your loan is approved.

Lenders often cap loan size based on DSCR. If the ratio falls below their minimum, they will likely reduce the amount they're willing to lend until the property meets that requirement.

For example, two properties each earn $200,000 in NOI. One pays $160,000 in debt service (DSCR 1.25); the other $180,000 (DSCR 1.11). The second would likely qualify for a smaller loan.

This isn't theoretical. Every month, Canadian investors lose out on properties because they didn't stress-test their DSCR ahead of time.

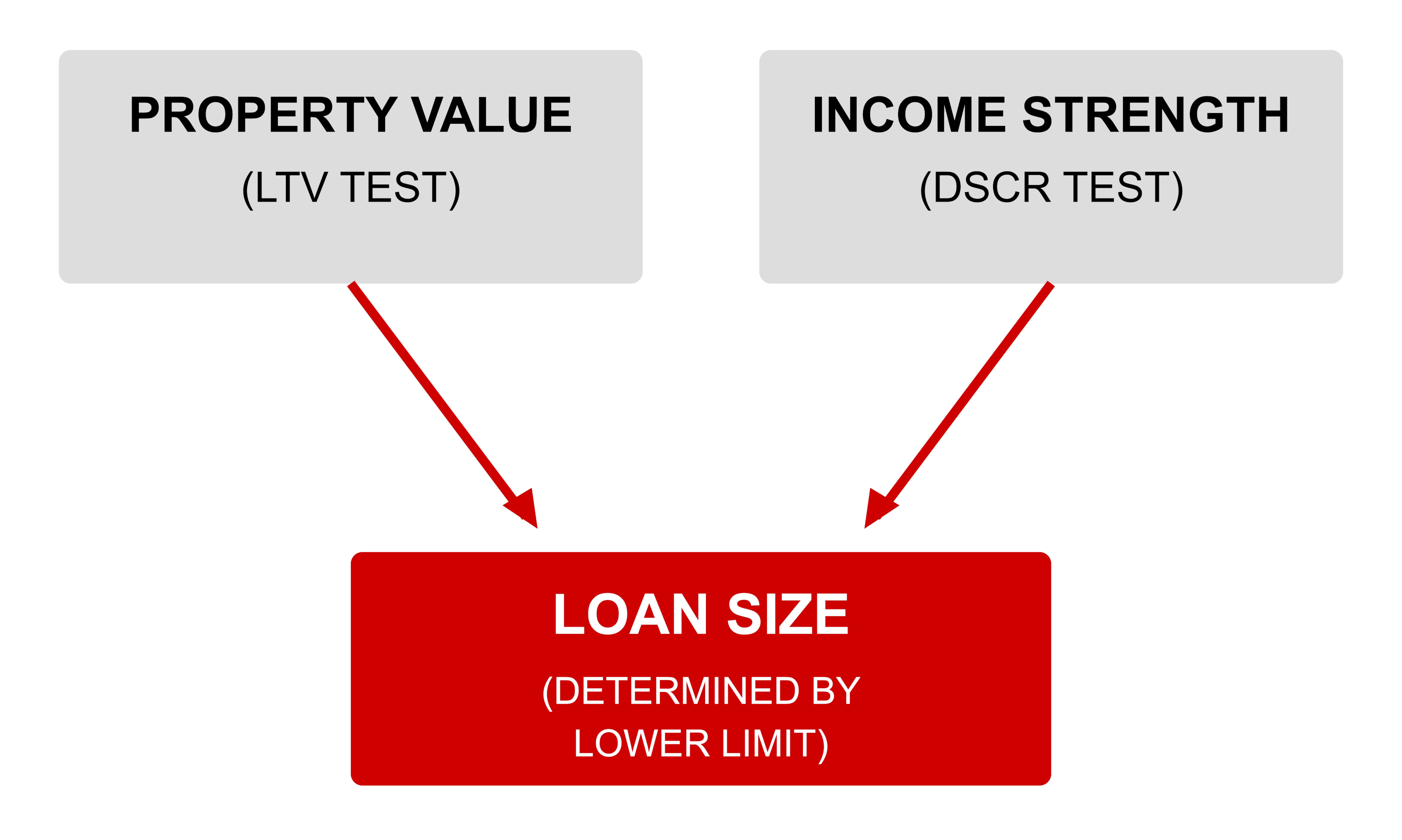

Lenders usually run two parallel tests when underwriting a deal: a loan-to-value (LTV) test based on property value and a DSCR test based on income strength. LTV measures how much of the property's value is being financed with debt, while DSCR focuses on whether income can comfortably cover loan payments. Together, they show lenders both the risk of the loan and the borrower's capacity to support it.

The funnel below shows how both metrics work together to determine the final approved loan amount. Whichever limit is reached first, value or income, sets the maximum financing.

How Can You Improve DSCR?

Boost their income, manage expenses, or adjust debt to build a safer buffer.

DSCR improves when a property earns more income or carries less debt. The strategies below help investors strengthen cash flow and improve long-term stability.

- Enhance income: Renew leases early, adjust rents to market levels, or add extra revenue from parking, storage, or leasing exterior space for signage.

- Trim expenses: Review service contracts, improve energy efficiency, and plan preventative maintenance to avoid unexpected costly repairs.

- Refinance or reduce debt: Extending amortisation or lowering rates reduces annual payments, while partial principal paydowns lift DSCR immediately.

For example, consider a property that earns $150,000 in NOI. If mortgage payments drop from $135,000 to $120,000 after refinancing, DSCR rises from 1.11 to 1.25. A higher DSCR after refinancing strengthens your financial position and reduces risk, which makes it easier to qualify for future loans or refinance again on better terms. This stability is one reason investors focusing on multifamily buildings with long-term tenants often see steadier income and fewer cash-flow gaps.

That improvement from 1.11 to 1.25 isn't just a better number on paper. It's what separates a deal that feels risky from one that looks solid to a lender. It can unlock lower rates, higher loan amounts, and faster approvals. For many investors, it's the factor that determines whether they secure the property or lose it to someone who's better prepared.

If your DSCR is below lender requirements, you can take steps to raise it through better income management, lower expenses, or refinancing to reduce payments.

What Are the Limitations of DSCR?

DSCR is powerful, but it leaves out key details investors should track.

DSCR does not include capital expenditures, tenant improvements, or leasing costs, all of which affect real cash flow. It also assumes stable rent and expenses, so sudden changes in taxes, vacancies, or rates can shift the ratio.

Relying solely on DSCR is like driving with only one eye open. You'll see part of the picture, but you'll miss critical details that could cost you. Investors who pair DSCR with LTV, cap rate, and cash-on-cash return catch problems before they become expensive mistakes and gain a clearer view of a property's long-term stability.

Used wisely, DSCR remains one of the most reliable ways to test a property's financial health and compare performance across commercial property classes. Explore commercial property for sale on LoopNet to see how DSCR, income stability, and financing potential connect in real-world examples.

Commercial Properties For Sale