What Is Net Operating Income and Why It Matters

Article Summary

- Net operating income (NOI) measures a property's income after operating expenses, taxes, and capital costs, providing a key indicator of financial performance and value.

- Understanding NOI helps investors compare opportunities, measure efficiency, and estimate value using cap rates.

- Improving NOI can directly increase property value, especially in sectors with tight yields such as industrial and retail real estate.

Net operating income (NOI) is the income a property generates after all necessary operating expenses are deducted. It's one of the most important metrics for evaluating performance and comparing investments across asset types.

The difference between a property that builds wealth and one that drains it often comes down to this single metric. Miss it, and you risk overpaying by hundreds of thousands.

Unlike gross income, which only shows revenue, NOI reveals how much a property truly earns after expenses such as maintenance, insurance, and property taxes. It's essentially the property's profit before financing costs.

For many first-time investors, mastering NOI is the first step toward comparing opportunities on an even playing field. Understanding how to calculate and interpret it gives you the confidence to make stronger, data-backed decisions.

According to the Canada Mortgage and Housing Corporation (CMHC), operating expenses typically account for about one-third of a property's gross income, depending on asset type and location. Knowing how to analyse NOI helps you spot stronger opportunities and avoid overpaying for properties that look better on paper than they really are.

How Is Net Operating Income Calculated?

Net operating income is calculated by subtracting operating expenses from the income a property generates.

Start with all the revenue the property earns, which is called gross operating income. From there, subtract the operating expenses needed to keep it running.

Common sources of gross operating income include rent, parking fees, and other recurring charges. Operating expenses can include property taxes, utilities, maintenance, insurance, and property-management fees, or anything required to keep the property functional and occupied.

If a property generates $500,000 in annual gross income and has $180,000 in operating expenses, its NOI is $320,000.

Why Does Net Operating Income Matter?

NOI plays a central role in valuing and comparing commercial properties.

NOI highlights how efficiently a property runs on its own. It gives investors and lenders a consistent way to compare performance, regardless of how the deal is financed or owned.

For first-time investors, NOI is the reality check that prevents costly mistakes. Two properties might list at similar prices, but their NOI tells you which one actually makes money. Understanding NOI is only half the picture; lenders also test whether that income can support financing through the debt service coverage ratio (DSCR).

One helpful metric derived from NOI is the cap rate. A cap rate, or capitalisation rate, expresses a property's expected return as a percentage:

This formula can also be reversed to estimate a property's market value:

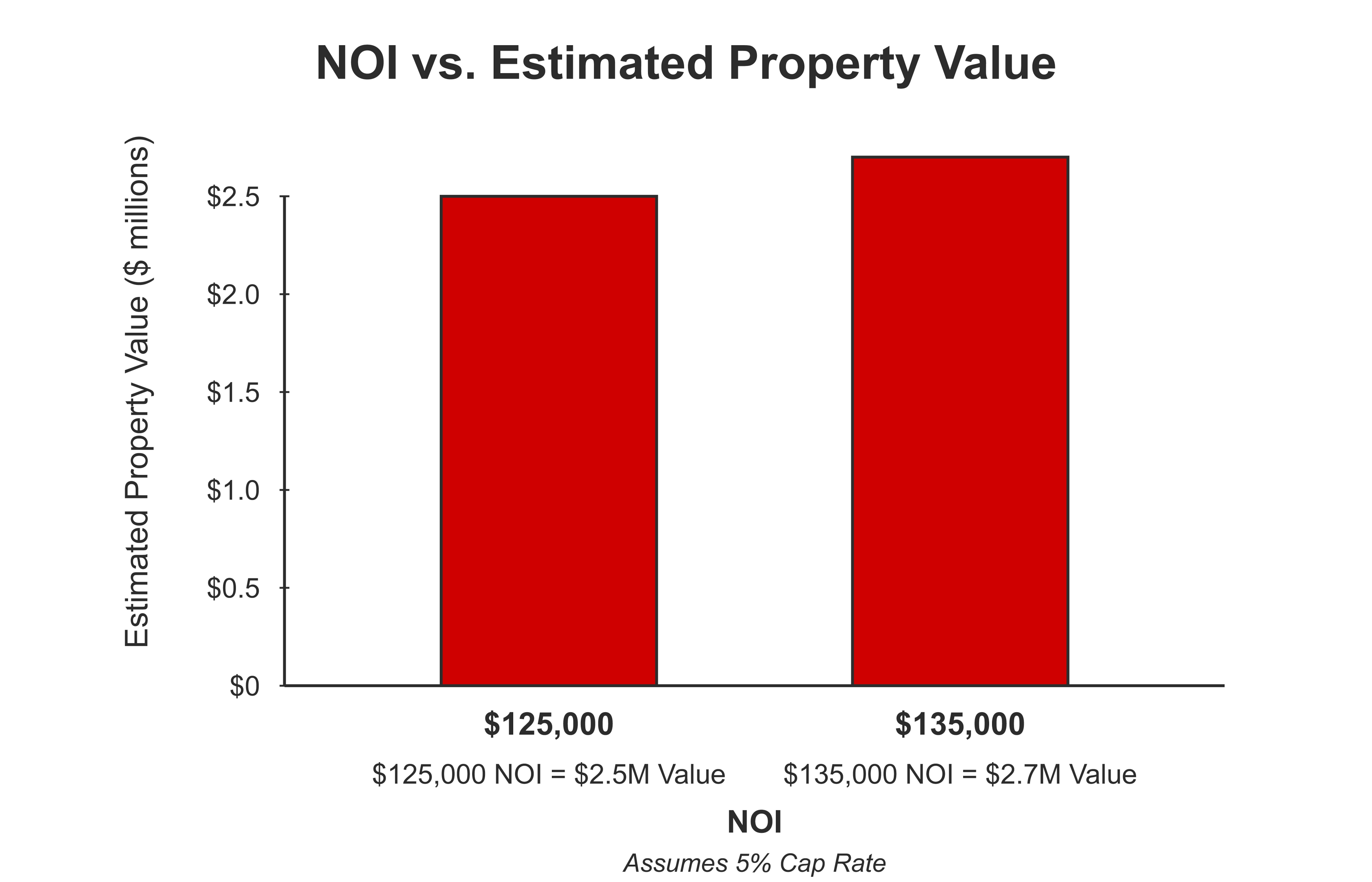

Here is an example. Suppose a property's NOI is $125,000 and comparable assets in the same market trade at a 5% cap rate. The implied market value would be $2.5 million.

You'll see this effect in Vancouver retail listings, where limited supply and strong tenant demand mean even small NOI differences can lead to noticeable price gaps.

The takeaway is simple: Property values tend to increase when income rises or expenses fall. That's why operational efficiency matters as much as market timing.

How Does Net Operating Income Affect Property Value?

Higher NOI generally means higher value through the cap rate relationship.

Cap rate links a property's income to its market value, making NOI a key driver of pricing across all sectors. When NOI rises, the property's implied value usually increases as well, assuming market conditions and cap rates remain stable.

Even modest changes can make a major difference in valuation. The example below shows how slight improvements in NOI can raise a property's worth at a 5% cap rate.

At a 5% yield, an additional $10,000 in NOI adds roughly $200,000 in value. This math illustrates why investors pay close attention to expense control, lease structure, and tenant stability.

Modest differences in NOI often separate offers on comparable assets, especially in markets with limited supply and high demand for logistics space.

What Operating Expenses Are Included or Excluded in NOI?

Only ongoing operating costs are included, while capital, tax, and financing costs are excluded.

This breakdown helps investors avoid common mistakes when classifying costs.

This table distinguishes between expenses that are included in NOI calculations and those that are excluded, helping investors accurately assess a property's operating performance.

| INCLUDED | EXCLUDED |

|---|---|

| Property management fees | Mortgage payments |

| Property taxes | Depreciation |

| Utilities | Leasing commissions |

| Maintenance and repairs | Capital expenditures |

Most property-related costs fall clearly into one of these two categories. Operating expenses include day-to-day costs required to keep the property running, such as taxes, insurance, utilities, and maintenance. Excluded costs are those tied to financing, ownership structure, or long-term improvements, such as mortgage payments, capital expenditures, and depreciation.

Different types of commercial leases determine whether tenants or owners absorb costs like insurance, taxes, or maintenance. Lease terms such as gross, net, or modified gross define how these costs are shared.

Understanding which costs belong in NOI helps ensure accurate comparisons between properties and prevents overstating income performance. Because definitions may vary slightly by appraiser or lender, always clarify what is included or excluded in your property financial projections.

How Can Investors Improve Net Operating Income?

Higher NOI comes from increasing income, controlling costs, or both.

Once you know how NOI is calculated, the next step is to identify what you can influence. In many cases, you have more control than you might think. Even modest improvements can make a noticeable difference in long-term value.

For instance, the owner of a small industrial unit might upgrade lighting and renegotiate service contracts. Those changes could cut annual expenses by a few thousand dollars. When it's sold, those savings can add tens of thousands to the property's value.

If you compare apartment buildings for sale in Calgary, you'll see how strong rental demand and competitive pricing make minor NOI gains especially valuable when properties go to market.

Ways to increase NOI include:

- Adjust rents to reflect current market rates.

- Reduce vacancy through better tenant retention.

- Control operating expenses through preventative maintenance.

- Add ancillary income sources such as parking or signage fees.

- Improve energy efficiency to reduce utility costs.

Even small operational changes can deliver significant results. For example, a small multifamily owner who reduces vacancy from 10% to 5% on a property generating $200,000 in potential rent adds $10,000 in NOI. At a 6% cap rate, that's $166,000 in additional property value from better tenant retention alone.

Gradual, consistent improvements can accumulate over time. Investors who monitor their operating expenses and review their lease structures regularly are better positioned to maintain steady NOI growth.

What Are the Limitations of Net Operating Income?

NOI is useful, but it does not tell the full story.

NOI is one of the most useful metrics in commercial real estate, but it doesn't tell the whole story. Two properties with identical NOI can deliver very different returns once financing, capital needs, or market timing come into play.

On its own, NOI focuses strictly on operating performance. It doesn't account for factors that can significantly affect overall returns, such as loan terms, capital expenditures, or tenant credit strength. Evaluating metrics like cash-on-cash return alongside NOI gives investors a clearer picture of how efficiently their equity is working.

For example, two buildings might each produce $250,000 in NOI, but if one carries higher debt service or needs major repairs in the next few years, the result is very different cash flows and investment outcomes.

Investors who use NOI alongside debt coverage ratios, market data, and projected capital requirements gain a much clearer picture of risk and long-term value.

Investor Takeaways

Real estate doesn't build wealth on its own. Understanding NOI gives you the clarity to choose wisely, the confidence to negotiate effectively, and a roadmap to strengthen returns year after year.

When you know how to calculate and interpret NOI, you gain a reliable lens for evaluating almost any property. It helps you compare opportunities side by side, identify inefficiencies, and plan improvements that drive stronger performance.

Many investors also analyse internal rate of return (IRR) using NOI as a foundation, since IRR builds on these cash flow insights to show how efficiently an investment grows over time.

Analysing NOI in detail also lets you forecast how changes in rent growth, occupancy, or expenses could influence returns over time.

Whether you own one property or a diversified portfolio, using NOI as your benchmark provides a clearer path to sustainable income and equity growth. Explore listings in Canada on LoopNet to see how NOI, rental income, and pricing align in real-world examples.

Commercial Properties For Sale