Se Connecter/S’inscrire

Votre courriel a été envoyé.

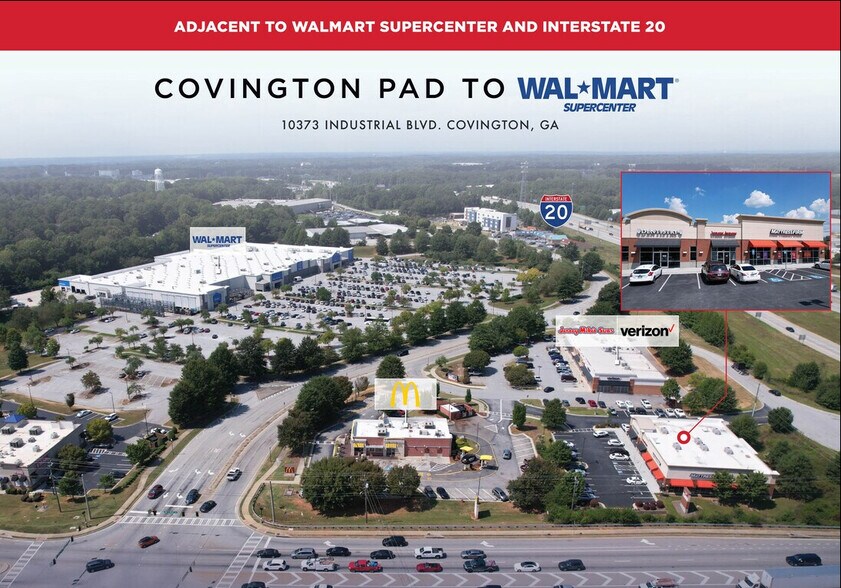

Outparcel Pad to Walmart SuperCenter 10373 Industrial Blvd NE 8 500 pi² 100% Loué Commerce de détail Immeuble Covington, GA 30014 5 162 482 $ CAD (607,35 $ CAD/pi²) 6,30% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

FAITS SAILLANTS DE L'INVESTISSEMENT

- MATTRESS FIRM (NYSE: SGI) | 2,300+ LOCATIONS | NATIONAL BRAND

- STRONG CONSUMER DRAW FROM ADJACENT WALMART SUPERCENTER AND HOME DEPOT

- ORIGINAL TENANTS | RECENT LEASE RENEWALS | 10 YEAR HISTORICAL OCCUPANCY

- 100% LEASED 3 TENANT PAD BUILDING | PART OF THE DOMINANT TRADE CENTER IN AREA

- KNOWN AS “HOLLYWOOD OF THE SOUTH” | HOME TO MAJOR ENTERTAINMENT STUDIOS

- TOP 6 AND 15 PERCENTILE STORE VISITS FOR WALMART AND HOME DEPOT RESPECTIVELY

RÉSUMÉ DE L'ANNONCE

6.65% Cap in Sept 2028 | Annual Rent Increases in 2 of 3 leases | 3 Tenant Pad | All Original Tenants Having Recent Lease Renewals

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest (land & building) in a multi-tenant pad building in Covington, GA, a growing suburb 35 miles east of Atlanta. The offering is anchored by Mattress Firm (NYSE:SGI) (2,300+ locations in 49 states). All tenants are original, have occupied the property for 10 years, and have recently renewed their lease. The Property boasts minimal maintenance and expenses obligations with the tenants operating under NNN leases, providing an investor ease of management with the tenants being responsible for taxes, insurance and common area maintenance expenses. More than one-half of the leasable square footage contains annual rent increases while Mattress Firm has their next rent increase in February 2028.

The offering is strategically positioned as an outparcel pad to a successful Walmart Supercenter which per Placer.ai ranks in the top 6 percentile for customer visits of all Walmart stores in Georgia. The drawing power of the Walmart Supercenter combined with visibility and convenient access to Interstate 20 enables the Property to out-position and outperform other multi-tenant properties in the under-supplied Covington retail market. As with most suburbs of Atlanta, Covington is anticipated to continue its strong population growth over the next 10 years. In addition to being home to Cinelease Studios, one of the largest film studios in the country, other major employers include General Mills, Bridgestone Golf, and Bard Medical.

This offering checks all the major boxes for an investor by having long term historical occupancies and a stabilized income stream. The location is strategically positioned to benefit from cross over shopping opportunities created by the adjacent top tier performing Walmart Supercenter while the growing population base will continue to support the tenants and help create appreciating real estate values in the immediate area.

BROKER OF RECORD.... NOVAK & ASSOCIATES, INC....License No. 6506

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest (land & building) in a multi-tenant pad building in Covington, GA, a growing suburb 35 miles east of Atlanta. The offering is anchored by Mattress Firm (NYSE:SGI) (2,300+ locations in 49 states). All tenants are original, have occupied the property for 10 years, and have recently renewed their lease. The Property boasts minimal maintenance and expenses obligations with the tenants operating under NNN leases, providing an investor ease of management with the tenants being responsible for taxes, insurance and common area maintenance expenses. More than one-half of the leasable square footage contains annual rent increases while Mattress Firm has their next rent increase in February 2028.

The offering is strategically positioned as an outparcel pad to a successful Walmart Supercenter which per Placer.ai ranks in the top 6 percentile for customer visits of all Walmart stores in Georgia. The drawing power of the Walmart Supercenter combined with visibility and convenient access to Interstate 20 enables the Property to out-position and outperform other multi-tenant properties in the under-supplied Covington retail market. As with most suburbs of Atlanta, Covington is anticipated to continue its strong population growth over the next 10 years. In addition to being home to Cinelease Studios, one of the largest film studios in the country, other major employers include General Mills, Bridgestone Golf, and Bard Medical.

This offering checks all the major boxes for an investor by having long term historical occupancies and a stabilized income stream. The location is strategically positioned to benefit from cross over shopping opportunities created by the adjacent top tier performing Walmart Supercenter while the growing population base will continue to support the tenants and help create appreciating real estate values in the immediate area.

BROKER OF RECORD.... NOVAK & ASSOCIATES, INC....License No. 6506

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL (CAD) | ANNUEL PAR pi² (CAD) |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Revenu net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | $99,999 |

| Annuel par pi² | $9.99 |

FAITS SUR LA PROPRIÉTÉ

Type de vente

Investissement

Type de propriété

Commerce de détail

Sous-type de propriété

Taille du bâtiment

8 500 pi²

Classe d’immeuble

B

Année de construction

2014

Prix

5 162 482 $ CAD

Prix par pi²

607,35 $ CAD

Taux de capitalisation

6,30%

Revenu net d’exploitation

325 188 $ CAD

Pourcentage loué

100%

Location

Multiples

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,21

Taille du lot

0,92 AC

COMMODITÉS

- Visibilité de l'autoroute

- Affichage

- Affichage sur monument

PRINCIPAUX DÉTAILLANTS À PROXIMITÉ

Impôts fonciers

| Numéro de lot | C081000000088000 | Évaluation des bâtiments | 334 477 $ CAD |

| Évaluation du terrain | 248 779 $ CAD | Évaluation totale | 583 256 $ CAD |

Impôts fonciers

Numéro de lot

C081000000088000

Évaluation du terrain

248 779 $ CAD

Évaluation des bâtiments

334 477 $ CAD

Évaluation totale

583 256 $ CAD

1 de 22

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

Présenté par

Outparcel Pad to Walmart SuperCenter | 10373 Industrial Blvd NE

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.