Se Connecter/S’inscrire

Votre courriel a été envoyé.

1047-1055 Linden Ave 8 625 pi² Commerce de détail Immeuble Dayton, OH 45410 618 946 $ CAD (71,76 $ CAD/pi²) 11,02% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

FAITS SAILLANTS DE L'INVESTISSEMENT

- 4 COMMERCIAL SPACES | THREE 3-BED/ 1-BA APARTMENTS

- BELOW MARKET COMMERCIAL RENTS- ALL MONTH TO MONTH

- VALUE ADD- RESIDENTIAL UNITS ARE VACANT

- DAYTON’S FIRST KROGER | LOCATED IN HISTORIC LINDEN HEIGHTS

RÉSUMÉ DE L'ANNONCE

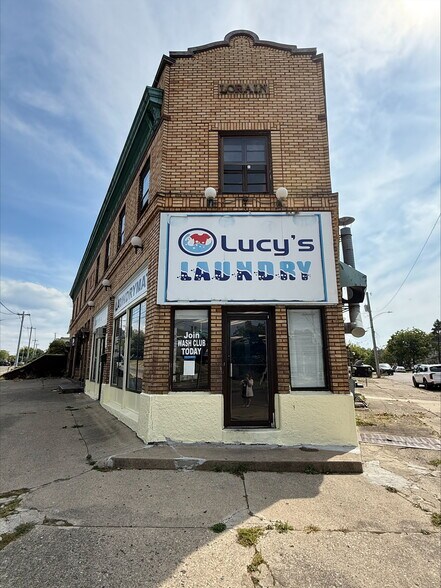

The Lorain Building, located on the corner of Linden Ave. and Wilfred Ave., presents an excellent opportunity for investors seeking a cash-flowing property with value-add potential. Home of the original Dayton Kroger, the building also carries significant historical character and community recognition.

The property is comprised of 4 commercial units, all currently rented, and 3 residential units, 3-Bed/1-Ba. The residential units likely need new paint and flooring to achieve market rents of approximately $1,100 per month. The commercial tenants are currently month-to-month, allowing for immediate rent adjustments.

Comparable sales in the area show single-family homes ranging from $135K–$160K and duplexes in the $200K range, supporting the value of this property with its three 3-bedroom residential units and four commercial spaces.

The current owner recently had residential tenants vacate with plans to complete renovations personally but has since relocated out of state, leaving the property ready for a new investor to complete updates and stabilize income quickly. Just before, the units were rented at an average of $750/Month in their current condition. A proposal for new windows and flooring (approx. $15,000) is available and will be shared with serious buyers.

(Property is agent owned.)

Financial Summary

Current Gross Income (all residential units vacant): $31,200

Previous Gross Income (with residential units rented at $750/month): $65,400

Projected Gross Income (at market residential rents, without adjusting commercial rents): $70,800

Estimated Operating Costs: $20,000 (low & self-managed)

The property is comprised of 4 commercial units, all currently rented, and 3 residential units, 3-Bed/1-Ba. The residential units likely need new paint and flooring to achieve market rents of approximately $1,100 per month. The commercial tenants are currently month-to-month, allowing for immediate rent adjustments.

Comparable sales in the area show single-family homes ranging from $135K–$160K and duplexes in the $200K range, supporting the value of this property with its three 3-bedroom residential units and four commercial spaces.

The current owner recently had residential tenants vacate with plans to complete renovations personally but has since relocated out of state, leaving the property ready for a new investor to complete updates and stabilize income quickly. Just before, the units were rented at an average of $750/Month in their current condition. A proposal for new windows and flooring (approx. $15,000) is available and will be shared with serious buyers.

(Property is agent owned.)

Financial Summary

Current Gross Income (all residential units vacant): $31,200

Previous Gross Income (with residential units rented at $750/month): $65,400

Projected Gross Income (at market residential rents, without adjusting commercial rents): $70,800

Estimated Operating Costs: $20,000 (low & self-managed)

FAITS SUR LA PROPRIÉTÉ

Type de vente

Investissement

Type de propriété

Commerce de détail

Sous-type de propriété

Commerce pied immeuble

Taille du bâtiment

8 625 pi²

Classe d’immeuble

C

Année de construction

1930

Prix

618 946 $ CAD

Prix par pi²

71,76 $ CAD

Taux de capitalisation

11,02%

Revenu net d’exploitation

68 236 $ CAD

Location

Multiples

Hauteur du bâtiment

2 étages

Coefficient d’occupation des sols de l’immeuble

1,12

Taille du lot

0,18 AC

Zonage

MR-5 - Zonage MR-5, qui permet les habitations unifamiliales, bifamiliales, multifamiliales, les unités d'habitation accessoires (UHA) ainsi que l'utilisation commerciale.

Façade

94’ sur Linden Ave

COMMODITÉS

- Ligne d'autobus

Impôts fonciers

| Numéro de lot | R72-04006-0021 | Évaluation des bâtiments | 60 360 $ CAD |

| Évaluation du terrain | 8 963 $ CAD | Évaluation totale | 69 323 $ CAD |

Impôts fonciers

Numéro de lot

R72-04006-0021

Évaluation du terrain

8 963 $ CAD

Évaluation des bâtiments

60 360 $ CAD

Évaluation totale

69 323 $ CAD

1 de 8

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

Présenté par

1047-1055 Linden Ave

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.