Se Connecter/S’inscrire

Votre courriel a été envoyé.

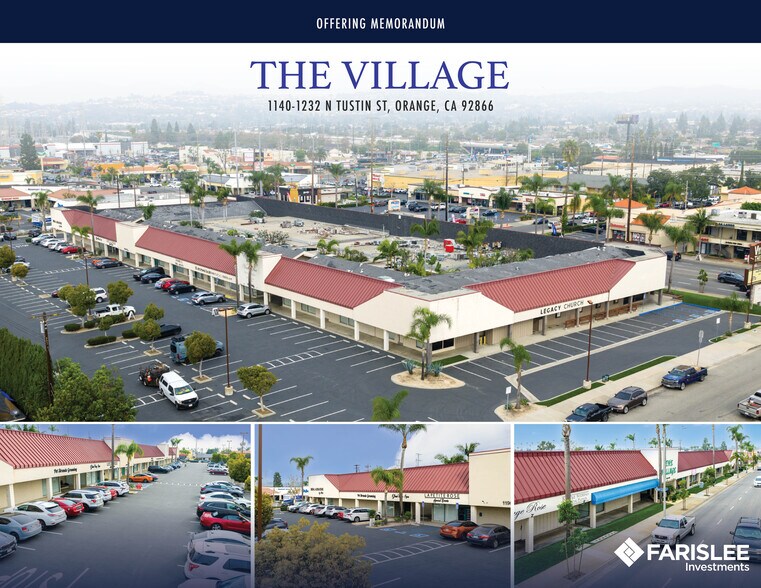

1140-1232 N Tustin St 47 804 pi² 100% Loué Commerce de détail Immeuble Orange, CA 92867 14 972 871 $ CAD (313,21 $ CAD/pi²)

Certaines informations ont été traduites automatiquement.

Faits saillants de l'investissement

- Large 3.46-Acre Lot, Offering a Land Value of $73/SF, Materially Below Prevailing Orange County Retail Land Values

- Flexible Lease Terms Providing Landlord Full Control Over Lease Economics

- Excellent Visibility Near Intersection of Tustin St. (±39,400 VPD) and Katella Ave. (±35,000 VPD)

- Under Market Rents Averaging $1.33/SF Gross, Well Below Comparable Neighborhood Retails Centers Along Tustin St.

- Well Below Replacement Cost at Approximately $230/SF

- Dense Infill Trade Area with Approximately 168,000 Residents, Average Household Incomes in Excess of $152,000 and Over 109,000 Daytime Employees

Résumé de l'annonce

Faris Lee Investments is pleased to present a fee simple interest in a multi-tenant value-add neighborhood retail center located on a 3.46-acre site in a dense infill submarket of Orange, California (“the Property”). The Property features prominent frontage and visibility along Tustin Street (±39,400 VPD) and is strategically positioned near the Interstate 55 corridor (±232,200 VPD), providing excellent access and exposure to both surrounding residential neighborhoods and regional employment centers. Multiple points of frontage and signage opportunities enhance tenant branding, leasing velocity, and long-term income stability.

The Property is offered at a compelling basis, with an implied land value of approximately $73 per square foot and an entry price of roughly $230 per square foot—well below prevailing land values and estimated replacement cost for comparable retail construction in Orange County. This low basis provides meaningful downside protection and creates flexibility for a future owner to invest capital into façade and signage upgrades, site circulation improvements, tenant reconfigurations, and longer-term repositioning without overcapitalizing the asset. Optionality exists to reposition the site to a higher and better use, subject to zoning and market conditions.

The investment is driven by near-term lease rollover and embedded rent growth. In-place rents average approximately $1.33 per square foot gross versus market rents of approximately $1.75 per square foot NNN. All leases roll within approximately three years and carry no remaining tenant options, providing ownership full control over lease economics, tenant mix, and lease structure, including the ability to convert leases to NNN and significantly grow NOI.

The Property benefits from strong infill demographics and a substantial daytime population, with approximately 168,000 residents within three miles and average household incomes exceeding $152,000, along with nearly 109,000 employees supporting weekday traffic. Combined with the Property’s high-exposure location, multiple frontage and signage opportunities, and strong access, the asset is well positioned for sustained tenant demand, value-add leasing, and long-term income growth.

The Property is offered at a compelling basis, with an implied land value of approximately $73 per square foot and an entry price of roughly $230 per square foot—well below prevailing land values and estimated replacement cost for comparable retail construction in Orange County. This low basis provides meaningful downside protection and creates flexibility for a future owner to invest capital into façade and signage upgrades, site circulation improvements, tenant reconfigurations, and longer-term repositioning without overcapitalizing the asset. Optionality exists to reposition the site to a higher and better use, subject to zoning and market conditions.

The investment is driven by near-term lease rollover and embedded rent growth. In-place rents average approximately $1.33 per square foot gross versus market rents of approximately $1.75 per square foot NNN. All leases roll within approximately three years and carry no remaining tenant options, providing ownership full control over lease economics, tenant mix, and lease structure, including the ability to convert leases to NNN and significantly grow NOI.

The Property benefits from strong infill demographics and a substantial daytime population, with approximately 168,000 residents within three miles and average household incomes exceeding $152,000, along with nearly 109,000 employees supporting weekday traffic. Combined with the Property’s high-exposure location, multiple frontage and signage opportunities, and strong access, the asset is well positioned for sustained tenant demand, value-add leasing, and long-term income growth.

Bilan financier (Réel - 2025) Cliquez ici pour accéder à |

Annuel (CAD) | Annuel par pi² (CAD) |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Revenu net d’exploitation |

$99,999

|

$9.99

|

Bilan financier (Réel - 2025) Cliquez ici pour accéder à

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | $99,999 |

| Annuel par pi² | $9.99 |

Faits sur la propriété

Type de vente

Investissement

Type de propriété

Commerce de détail

Sous-type de propriété

Taille du bâtiment

47 804 pi²

Classe d’immeuble

B

Année de construction

1965

Prix

14 972 871 $ CAD

Prix par pi²

313,21 $ CAD

Pourcentage loué

100%

Location

Multiples

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,32

Taille du lot

3,46 AC

Zonage

C-TR - Limited Business - Tustin Redevelopment Project Area

Stationnement

208 places (4,35 places par 1 000 pi² loué)

Façade

Commodités

- Atrium

- Lot de coin

- Cour

- Aire de restauration

- Enseigne sur pylône

- Affichage

Walk Score®

Très pratique à pied (83)

Principaux détaillants à proximité

Impôts fonciers

| Numéro de lot | 375-391-38 | Évaluation des bâtiments | 2 759 101 $ CAD |

| Évaluation du terrain | 2 361 479 $ CAD | Évaluation totale | 5 120 579 $ CAD |

Impôts fonciers

Numéro de lot

375-391-38

Évaluation du terrain

2 361 479 $ CAD

Évaluation des bâtiments

2 759 101 $ CAD

Évaluation totale

5 120 579 $ CAD

1 de 16

Vidéos

Visite extérieure 3D Matterport

Visite 3D Matterport

Photos

Vue depuis la rue

Rue

Carte

Présenté par

1140-1232 N Tustin St

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.

Votre message a été envoyé !

Activez votre compte LoopNet dès maintenant pour suivre les propriétés, recevoir des alertes en temps réel, gagner du temps sur vos demandes futures et bien plus encore.