Se Connecter/S’inscrire

Votre courriel a été envoyé.

Albert's Mexican Food & VANS 11610 Imperial Hwy 5 800 pi² 100% Loué Commerce de détail Immeuble Norwalk, CA 90650 5 441 584 $ CAD (938,20 $ CAD/pi²) 5,50% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

Faits saillants de l'investissement

- Established Tenancies – Long-Term Occupancy & Credit Stability

- Ease of Management – Passive NNN Lease Structure

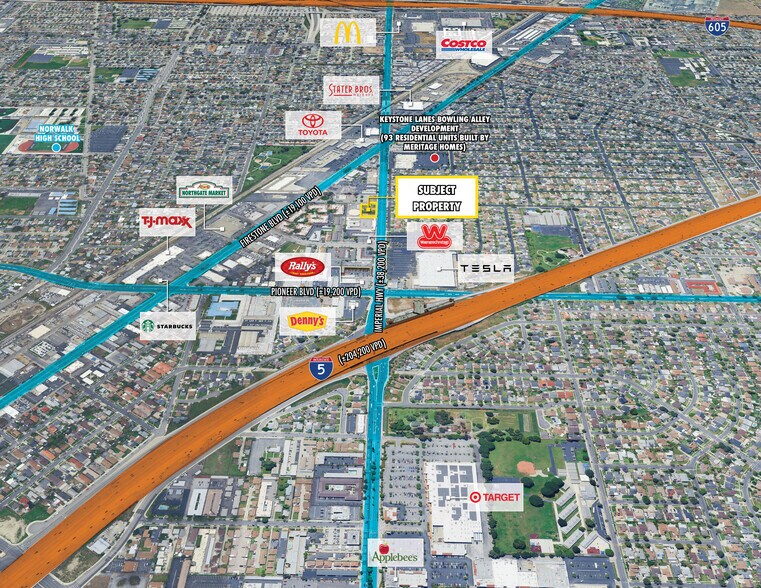

- High-Traffic Arterial Location | Pole & Monument Signage at Intersection

- Embedded Upside – Below-Market Rents & Near-Term Lease Rollover

- Prime Los Angeles County Demographics

- Unparalleled Retail Synergy – Surrounded by Top-Ranked National Dining Brands

Résumé de l'annonce

Faris Lee Investments is pleased to present the unique opportunity to acquire a fee simple interest (land and building) in a multi-tenant retail asset located along Imperial Highway in Norwalk, California (“the Property”). The Property is currently occupied by two well-established tenants, Vans and Albert’s Mexican Food, both with decades of operating history at this location. Vans operates under a corporate lease executed by VF Outdoor, LLC, the principal operating subsidiary of VF Corporation (NYSE: VFC), providing strong credit backing from a $9.5 billion global apparel company. Albert’s Mexican Food has been a local staple since 2009, generating consistent daily traffic and highlighting the strength of both the tenants and the site itself.

The Property offers significant embedded upside, as both tenants are currently on short-term leases with no remaining options. Albert’s Mexican Food is paying rent materially below market rates for comparable drive-thru QSR assets, creating immediate mark-to-market potential. The Vans lease presents additional value-add opportunities, allowing an investor to negotiate a long-term extension leveraging Vans’ 28-year operating history or recapture the space to re-tenant at market rates. This near-term lease rollover provides flexibility to enhance cash flow, increase weighted average lease term, and align the tenancies with an investor’s long-term objectives.

Structured as a Triple Net (NNN) asset, the Tenants are responsible for property taxes, insurance, common area maintenance (CAM), and HVAC, delivering a truly passive investment with minimal operational responsibilities. This structure, combined with the Property’s high-visibility location at the signalized intersection of Imperial Highway and Jersey Avenue and proximity to the on/off ramps for Interstates 5, 605, and 105, provides a highly attractive, low-management income stream. The Property also benefits from large pole and monument signage, ensuring unmatched tenant exposure to both local and commuter traffic.

The Property is strategically positioned in a dense, high-barrier-to-entry trade area of Los Angeles County, with over 223,000 residents, nearly 100,000 daytime employees, and an average household income exceeding $116,000 within a three-mile radius. Additionally, the asset is situated amidst significant area redevelopment, including over 600 new residential units planned or underway through the Keystone Lanes redevelopment, Primestor’s “The Walk” mixed-use district, and the Alondra Maidstone project, further enhancing consumer density and supporting long-term tenant demand in the immediate trade area.

The Property offers significant embedded upside, as both tenants are currently on short-term leases with no remaining options. Albert’s Mexican Food is paying rent materially below market rates for comparable drive-thru QSR assets, creating immediate mark-to-market potential. The Vans lease presents additional value-add opportunities, allowing an investor to negotiate a long-term extension leveraging Vans’ 28-year operating history or recapture the space to re-tenant at market rates. This near-term lease rollover provides flexibility to enhance cash flow, increase weighted average lease term, and align the tenancies with an investor’s long-term objectives.

Structured as a Triple Net (NNN) asset, the Tenants are responsible for property taxes, insurance, common area maintenance (CAM), and HVAC, delivering a truly passive investment with minimal operational responsibilities. This structure, combined with the Property’s high-visibility location at the signalized intersection of Imperial Highway and Jersey Avenue and proximity to the on/off ramps for Interstates 5, 605, and 105, provides a highly attractive, low-management income stream. The Property also benefits from large pole and monument signage, ensuring unmatched tenant exposure to both local and commuter traffic.

The Property is strategically positioned in a dense, high-barrier-to-entry trade area of Los Angeles County, with over 223,000 residents, nearly 100,000 daytime employees, and an average household income exceeding $116,000 within a three-mile radius. Additionally, the asset is situated amidst significant area redevelopment, including over 600 new residential units planned or underway through the Keystone Lanes redevelopment, Primestor’s “The Walk” mixed-use district, and the Alondra Maidstone project, further enhancing consumer density and supporting long-term tenant demand in the immediate trade area.

Bilan financier (Réel - 2025) Cliquez ici pour accéder à |

Annuel (CAD) | Annuel par pi² (CAD) |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Revenu net d’exploitation |

$99,999

|

$9.99

|

Bilan financier (Réel - 2025) Cliquez ici pour accéder à

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | $99,999 |

| Annuel par pi² | $9.99 |

Faits sur la propriété

Type de vente

Investissement

Type de propriété

Taille du bâtiment

5 800 pi²

Année de construction

1978

Prix

5 441 584 $ CAD

Prix par pi²

938,20 $ CAD

Taux de capitalisation

5,50%

Revenu net d’exploitation

299 321 $ CAD

Pourcentage loué

100%

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,19

Taille du lot

0,69 AC

Zonage

Commercial

Commodités

- Enseigne sur pylône

- Service au volant

Walk Score®

Très pratique à pied (84)

Principaux détaillants à proximité

Denny's

Impôts fonciers

| Numéros de lot | Évaluation des bâtiments | 1 255 479 $ CAD | |

| Évaluation du terrain | 1 249 644 $ CAD | Évaluation totale | 2 505 123 $ CAD |

Impôts fonciers

Numéros de lot

Évaluation du terrain

1 249 644 $ CAD

Évaluation des bâtiments

1 255 479 $ CAD

Évaluation totale

2 505 123 $ CAD

1 de 11

Vidéos

Visite extérieure 3D Matterport

Visite 3D Matterport

Photos

Vue depuis la rue

Rue

Carte

Présenté par

Albert's Mexican Food & VANS | 11610 Imperial Hwy

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.

Votre message a été envoyé !

Activez votre compte LoopNet dès maintenant pour suivre les propriétés, recevoir des alertes en temps réel, gagner du temps sur vos demandes futures et bien plus encore.