Se Connecter/S’inscrire

Votre courriel a été envoyé.

New Wawa / 20 YR ABS NNN Lease/$143,000 AHHI 12408 Taylorsville Rd 5 915 pi² Commerce de détail Immeuble Louisville, KY 40299 6 815 378 $ CAD (1 152,22 $ CAD/pi²) 5% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

Faits saillants de l'investissement

- INVESTMENT GRADE CREDIT (BBB: FITCH RATING) - CORPORATE EXECUTED GROUND LEASE

- ABSOLUTE TRIPLE NET (NNN) LEASE / NO LANDLORD RESPONSIBILITIES/ TENANT BUILT & PAID FOR THEIR NEW BUILDING & COMMON AREA

- LONG TERM LEASE - 20 YEAR PRIMARY TERM WITH 6-5 YEAR LEASE OPTIONS

- STREET FRONTAGE PAD LOCATION – ADJACENT TO PROPOSED NEW PUBLIX SUPERMARKET

- BRAND NEW 2026 CONSTRUCTION – PROTOTYPICAL STORE LAYOUT / 16 FUEL PUMPS WITH C-STORE

- LARGE LAND PARCEL – 2.60 ACRES

Résumé de l'annonce

KENTUCKY BROKER OF RECORD .... TRIO Commercial Property Group / Justin Baker / License No.204053

Faris Lee Investments and TRIO Commerical Property Group are pleased to present the unique opportunity to acquire a brand-new, corporate-guaranteed Wawa situated in Louisville, Kentucky within a Publix anchored shopping center. The property is secured by a recently executed 20-year primary lease term with Wawa, Inc., a premier investment-grade tenant with a BBB rating from Fitch. Wawa is a legendary, privately held company with a history spanning over 120 years and currently operates more than 1,100 locations across 14 states. Ranked #22 on the Forbes list of America’s Largest Private Companies, Wawa’s financial strength is formidable, with fiscal year 2024 annual revenues exceeding $21 billion. The company’s operational excellence is reflected in its performance metrics, which significantly lead the industry; Wawa averages $7.1 million in merchandise sales per store—nearly triple the national average—and fuel sales of 3.1 billion gallons annually, averaging 69,042 gallons per week per store, which is more than double the industry standard.

The investment offers an exceptional degree of security and stability, featuring a 20-year primary term complemented by six, five-year renewal options that allow for a potential total lease term of 50 years. The absolute triple-net (NNN) lease structure ensures a completely passive ownership experience with zero landlord responsibilities. The tenant is responsible for the payment of all property taxes, insurance, and utilities, as well as the repair and maintenance of the entire premises, including the building, roof, parking lot, and landscaping. This “hands-off” management profile makes the asset a perfect selection for out-of-state or 1031-exchange investors seeking a reliable, long-term income stream. The property consists of brand-new construction utilizing Wawa’s latest prototypical store layout, which not only maximizes operational efficiency and sales volume but also eliminates the risk of deferred maintenance or near-term capital expenditures.

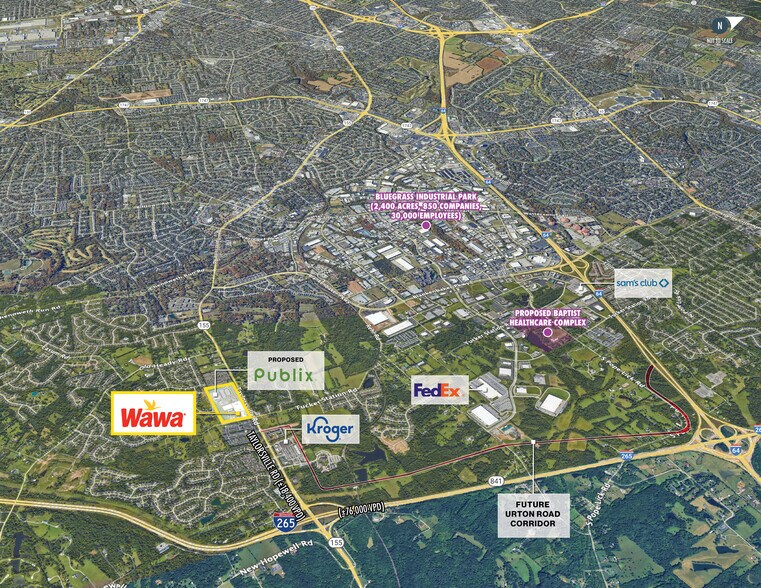

Strategically positioned on a high-profile, 2.60-acre pad, the property is situated within a proposed shopping center anchored by a brand-new Publix Supermarket. This location creates a high-traffic “daily needs” synergy, as the presence of a top-tier grocer ensures a consistent flow of consumers to the immediate site. The asset benefits from excellent visibility and prominent frontage along Taylorsville Road (Hwy 155), a major artery leading directly into downtown Louisville that carries about 18,400 vehicles per day. Furthermore, its immediate proximity to the Interstate 265 interchange provides the site with regional accessibility and exposure to roughly 76,000 vehicles per day. This combination of investment-grade credit, a long-term passive lease, and prime real estate within a high-growth retail corridor makes this Wawa location one of the most sought-after single-tenant products currently available in the marketplace.

Faris Lee Investments and TRIO Commerical Property Group are pleased to present the unique opportunity to acquire a brand-new, corporate-guaranteed Wawa situated in Louisville, Kentucky within a Publix anchored shopping center. The property is secured by a recently executed 20-year primary lease term with Wawa, Inc., a premier investment-grade tenant with a BBB rating from Fitch. Wawa is a legendary, privately held company with a history spanning over 120 years and currently operates more than 1,100 locations across 14 states. Ranked #22 on the Forbes list of America’s Largest Private Companies, Wawa’s financial strength is formidable, with fiscal year 2024 annual revenues exceeding $21 billion. The company’s operational excellence is reflected in its performance metrics, which significantly lead the industry; Wawa averages $7.1 million in merchandise sales per store—nearly triple the national average—and fuel sales of 3.1 billion gallons annually, averaging 69,042 gallons per week per store, which is more than double the industry standard.

The investment offers an exceptional degree of security and stability, featuring a 20-year primary term complemented by six, five-year renewal options that allow for a potential total lease term of 50 years. The absolute triple-net (NNN) lease structure ensures a completely passive ownership experience with zero landlord responsibilities. The tenant is responsible for the payment of all property taxes, insurance, and utilities, as well as the repair and maintenance of the entire premises, including the building, roof, parking lot, and landscaping. This “hands-off” management profile makes the asset a perfect selection for out-of-state or 1031-exchange investors seeking a reliable, long-term income stream. The property consists of brand-new construction utilizing Wawa’s latest prototypical store layout, which not only maximizes operational efficiency and sales volume but also eliminates the risk of deferred maintenance or near-term capital expenditures.

Strategically positioned on a high-profile, 2.60-acre pad, the property is situated within a proposed shopping center anchored by a brand-new Publix Supermarket. This location creates a high-traffic “daily needs” synergy, as the presence of a top-tier grocer ensures a consistent flow of consumers to the immediate site. The asset benefits from excellent visibility and prominent frontage along Taylorsville Road (Hwy 155), a major artery leading directly into downtown Louisville that carries about 18,400 vehicles per day. Furthermore, its immediate proximity to the Interstate 265 interchange provides the site with regional accessibility and exposure to roughly 76,000 vehicles per day. This combination of investment-grade credit, a long-term passive lease, and prime real estate within a high-growth retail corridor makes this Wawa location one of the most sought-after single-tenant products currently available in the marketplace.

Faits sur la propriété

Type de vente

Investissement pour loyer hypernet

Type de propriété

Commerce de détail

Sous-type de propriété

Taille du bâtiment

5 915 pi²

Classe d’immeuble

B

Année de construction

2026

État de la construction

En construction

Prix

6 815 378 $ CAD

Prix par pi²

1 152,22 $ CAD

Taux de capitalisation

5%

Revenu net d’exploitation

340 738 $ CAD

Location

Unique

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,05

Taille du lot

2,60 AC

Zonage

C1

Façade

110’ sur Taylorsville Road

Commodités

- Climatisation

Principaux détaillants à proximité

Impôts fonciers

| Numéro de lot | 004602510000 | Évaluation des bâtiments | 0 $ CAD |

| Évaluation du terrain | 680 585 $ CAD | Évaluation totale | 680 585 $ CAD |

Impôts fonciers

Numéro de lot

004602510000

Évaluation du terrain

680 585 $ CAD

Évaluation des bâtiments

0 $ CAD

Évaluation totale

680 585 $ CAD

1 de 5

Vidéos

Visite extérieure 3D Matterport

Visite 3D Matterport

Photos

Vue depuis la rue

Rue

Carte

Présenté par

New Wawa / 20 YR ABS NNN Lease/$143,000 AHHI | 12408 Taylorsville Rd

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.

Votre message a été envoyé !

Activez votre compte LoopNet dès maintenant pour suivre les propriétés, recevoir des alertes en temps réel, gagner du temps sur vos demandes futures et bien plus encore.