Se Connecter/S’inscrire

Votre courriel a été envoyé.

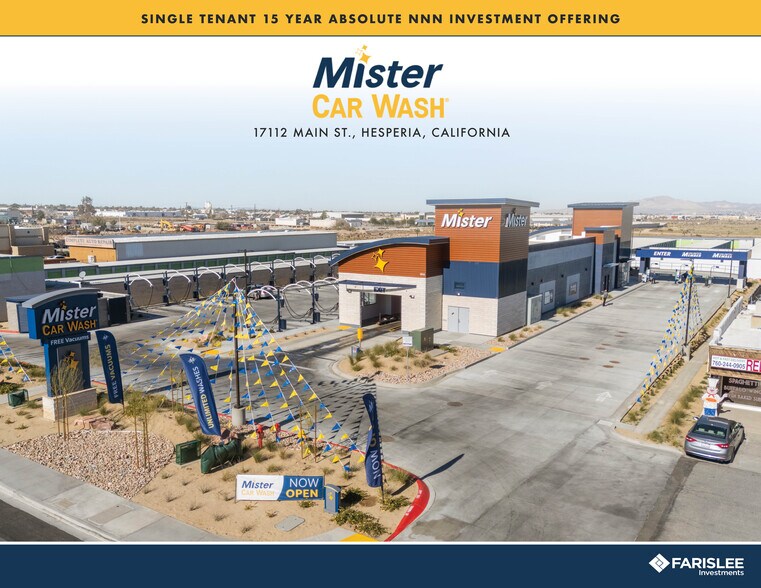

Mister Car Wash-15 YR Abs NNN Lse-Low Rent 17112-17122 Main St 6 474 pi² Commerce de détail Immeuble Hesperia, CA 92345 4 556 978 $ CAD (703,89 $ CAD/pi²) 6% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

Faits saillants de l'investissement

- CORPORATE LEASE WITH NYSE-LISTED MISTER CAR WASH, THE LARGEST U.S. CAR WASH OPERATOR WITH 500+ LOCATIONS AND $1B+ IN ANNUAL REVENUE

- NEW 15-YEAR LEASE WITH MULTIPLE RENEWAL OPTIONS PROVIDING UP TO 34 YEARS OF LONG-TERM INCOME STABILITY

- ABSOLUTE NNN LEASE WITH TENANT COVERING ALL EXPENSES, OFFERING HASSLE-FREE, PASSIVE INVESTMENT

- STRICT CITY OF HESPERIA DEVELOPMENT CODES LIMIT NEW CAR WASH SUPPLY, ENHANCING VALUE OF EXISTING FACILITIES

- BELOW-MARKET RENT CREATES FUTURE NOI UPSIDE AND LONG-TERM INVESTOR VALUE

- RENT INCREASES AND NEW PROTOTYPE CONSTRUCTION PROVIDE GROWING CASH FLOW AND HIGH VALUE

Résumé de l'annonce

Faris Lee Investments is pleased to present the unique opportunity to acquire a brand new, corporate-executed absolute NNN ground lease with Mister Car Wash (NYSE: MCW), the largest car wash operator in the United States. With over 500 locations across 22 states and trailing twelve-month revenue exceeding $1 billion as of Q3 2025, the tenant offers established financial strength and brand recognition. This offering features a long-term fifteen (15) year primary lease with 3 (5 year) and 1 (4 Year) options, potentially extending the term to 34 years, providing exceptional long-term stability and security for the investor.

Development standards adopted by the City of Hesperia create a significant advantage by limiting future car wash supply. With new zoning and spacing restrictions designed to prevent market saturation, the City has established high barriers to entry for new competitors. This regulatory environment secures a protected market position for the asset, preserving market share and enhancing long-term value.

An Absolute Triple Net (NNN) Ground Lease structure ensures a completely passive ownership experience, with the tenant directly responsible for all property operations, including roof, structure, parking lot, repairs, maintenance, taxes, utilities, and insurance. Ideally suited for the passive investor or 1031 Exchange buyer, the lease also provides a growing income stream with 10% increases every five years, acting as a hedge against inflation & an increased return on investment. Furthermore, the current annual rent of $200,000 is significantly below the estimated market range of $225,000 to $400,000, creating intrinsic value and potential for future Net Operating Income (NOI) growth.

Situated as a freestanding property on the high-profile retail corridor along Main Street (32,900 VPD), Mister Car Wash is strategically positioned between two high-volume supermarket-anchored centers: Stater Bros. Markets and Vallarta Supermarket creating strong synergy & demand in the immediate trade area. This brand-new construction features the tenant’s latest prototypical layout, designed to increase sales volume while eliminating deferred maintenance. Hesperia serves as a vital hub along the highly trafficked Interstate 15 corridor connecting Coastal Southern California to Nevada, and the immediate trade area benefits from consistent daily needs traffic generated by the surrounding grocery anchors.

Development standards adopted by the City of Hesperia create a significant advantage by limiting future car wash supply. With new zoning and spacing restrictions designed to prevent market saturation, the City has established high barriers to entry for new competitors. This regulatory environment secures a protected market position for the asset, preserving market share and enhancing long-term value.

An Absolute Triple Net (NNN) Ground Lease structure ensures a completely passive ownership experience, with the tenant directly responsible for all property operations, including roof, structure, parking lot, repairs, maintenance, taxes, utilities, and insurance. Ideally suited for the passive investor or 1031 Exchange buyer, the lease also provides a growing income stream with 10% increases every five years, acting as a hedge against inflation & an increased return on investment. Furthermore, the current annual rent of $200,000 is significantly below the estimated market range of $225,000 to $400,000, creating intrinsic value and potential for future Net Operating Income (NOI) growth.

Situated as a freestanding property on the high-profile retail corridor along Main Street (32,900 VPD), Mister Car Wash is strategically positioned between two high-volume supermarket-anchored centers: Stater Bros. Markets and Vallarta Supermarket creating strong synergy & demand in the immediate trade area. This brand-new construction features the tenant’s latest prototypical layout, designed to increase sales volume while eliminating deferred maintenance. Hesperia serves as a vital hub along the highly trafficked Interstate 15 corridor connecting Coastal Southern California to Nevada, and the immediate trade area benefits from consistent daily needs traffic generated by the surrounding grocery anchors.

Bilan financier (Réel - 2025) |

Annuel (CAD) | Annuel par pi² (CAD) |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Revenu net d’exploitation |

273 446 $

|

42,24 $

|

Bilan financier (Réel - 2025)

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | 273 446 $ |

| Annuel par pi² | 42,24 $ |

Faits sur la propriété

Type de vente

Investissement

Type de propriété

Taille du bâtiment

6 474 pi²

Classe d’immeuble

B

Année de construction

2025

Prix

4 556 978 $ CAD

Prix par pi²

703,89 $ CAD

Taux de capitalisation

6%

Revenu net d’exploitation

273 446 $ CAD

Location

Unique

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,11

Taille du lot

1,37 AC

Zonage

Commercial - Commerce de détail

Principaux détaillants à proximité

1 de 11

Vidéos

Visite extérieure 3D Matterport

Visite 3D Matterport

Photos

Vue depuis la rue

Rue

Carte

Présenté par

Mister Car Wash-15 YR Abs NNN Lse-Low Rent | 17112-17122 Main St

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.

Votre message a été envoyé !

Activez votre compte LoopNet dès maintenant pour suivre les propriétés, recevoir des alertes en temps réel, gagner du temps sur vos demandes futures et bien plus encore.