Se Connecter/S’inscrire

Votre courriel a été envoyé.

LEROY APARTMENTS | 9 Units | Steps From Cal 2411 Durant Ave 9 Unité Immeuble d’appartements 4 349 499 $ CAD (483 278 $ CAD/Unité) 5,59% Taux de capitalisation Berkeley, CA 94704

Certaines informations ont été traduites automatiquement.

FAITS SAILLANTS DE L'INVESTISSEMENT

- Irreplaceable Location Just 1 Block From UC Berkeley

- Opportunity to Furnish Units

- Flexible Acquisition Opportunity - Purchase Individually or as a Portfolio - 2411 Durant Ave (9 Units), 2419 Durant Avenue (32 units) and 2525 Durant

- Ideal for Student Housing

- High Demand Due to UC Berkeley's Growing Population & Housing Shortage

- Opportunity to Increase Bedroom Count

RÉSUMÉ DE L'ANNONCE

Property tours are available by appointment.

Disclosure package & marketing flyer available upon request.

The Cushman & Wakefield Northern California Multifamily Capital Markets Group is pleased to present The Leroy Apartments, a distinguished 9-unit multifamily asset in an irreplaceable location at 2411 Durant Avenue in the highly sought-after Southside neighborhood of Berkeley, CA. Built in 1917, this 5,603-square foot property boasts classic architectural character and presents a prime investment opportunity just steps away from the world-renowned UC Berkeley campus. Offered for the first time in more than 50 years, The Leroy Apartments represents a truly unique chance to secure a generational multifamily investment in one of the Bay Area's most dynamic rental markets.

The property’s unit mix consists of 4 studios and 5 two-bedroom units, catering to a diverse range of tenants, including UC Berkeley students, faculty, and local professionals direct adjacency to UC Berkeley. The Property offers significant value-add potential for an investor to implement property upgrades and reposition the asset as a student focused housing option.

The Leroy is offered at an attractive asking price of $3,135,000 ($348,333 per unit), with a stabilized cap rate of 5.59% and a proforma cap rate of 7.24%. The property’s stabilized rents average $2,473 per unit, while market rents average $3,011. This spread highlights strong rent growth trends and provides meaningful upside potential through repositioning and unit upgrades.

Operationally, the property is well-positioned for continued demand, featuring individually metered electricity and gas, while the landlord is responsible for water, sewer, and waste services.

Located in a highly walkable area with a Walk Score of 99 and Bike Score of 93, The Leroy offers excellent accessibility to UC Berkeley, major bus lines, and the BART system. The property’s proximity to Telegraph Avenue, Berkeley’s main commercial corridor, provides residents with convenient access to a wide range of retail and dining options.

Demand for housing in an irreplaceable location, that is well-amenitized in supply-constrained Southside submarket remains strong, driven by UC Berkeley’s ongoing bed shortage and consistent student, staff and faculty population growth. Rent growth in the area has increased by 25% over the past 10 years, and is projected to exceed 23% through 2035. This, combined with the Leroy's classic construction, irreplaceable location, and significant rent upside, makes the Property an exceptional opportunity for investors seeking both stable in-place income and long-term capital appreciation.

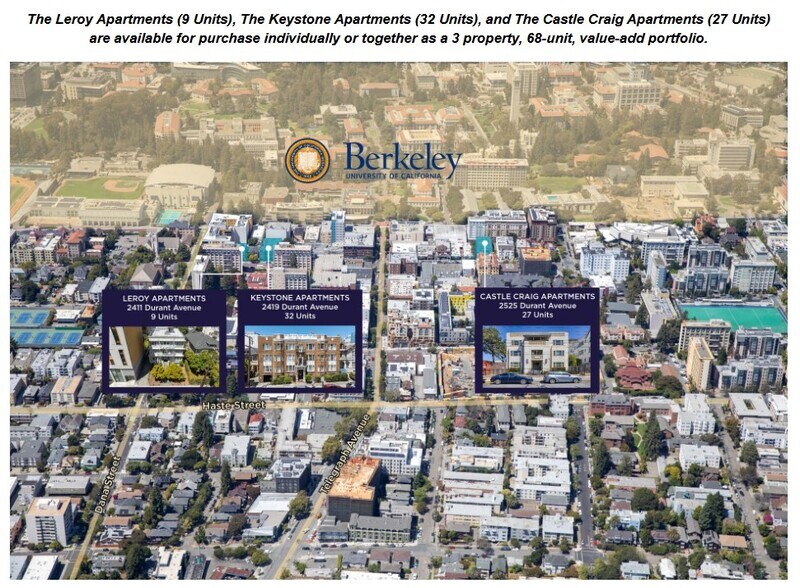

The property may be purchased individually or as a 3 property, 68-unit portfolio with The Keystone Apartments (2419 Durant Ave - 32 Units) and The Castle Craig Apartments (2525 Durant Ave - 27 Units).

Disclosure package & marketing flyer available upon request.

The Cushman & Wakefield Northern California Multifamily Capital Markets Group is pleased to present The Leroy Apartments, a distinguished 9-unit multifamily asset in an irreplaceable location at 2411 Durant Avenue in the highly sought-after Southside neighborhood of Berkeley, CA. Built in 1917, this 5,603-square foot property boasts classic architectural character and presents a prime investment opportunity just steps away from the world-renowned UC Berkeley campus. Offered for the first time in more than 50 years, The Leroy Apartments represents a truly unique chance to secure a generational multifamily investment in one of the Bay Area's most dynamic rental markets.

The property’s unit mix consists of 4 studios and 5 two-bedroom units, catering to a diverse range of tenants, including UC Berkeley students, faculty, and local professionals direct adjacency to UC Berkeley. The Property offers significant value-add potential for an investor to implement property upgrades and reposition the asset as a student focused housing option.

The Leroy is offered at an attractive asking price of $3,135,000 ($348,333 per unit), with a stabilized cap rate of 5.59% and a proforma cap rate of 7.24%. The property’s stabilized rents average $2,473 per unit, while market rents average $3,011. This spread highlights strong rent growth trends and provides meaningful upside potential through repositioning and unit upgrades.

Operationally, the property is well-positioned for continued demand, featuring individually metered electricity and gas, while the landlord is responsible for water, sewer, and waste services.

Located in a highly walkable area with a Walk Score of 99 and Bike Score of 93, The Leroy offers excellent accessibility to UC Berkeley, major bus lines, and the BART system. The property’s proximity to Telegraph Avenue, Berkeley’s main commercial corridor, provides residents with convenient access to a wide range of retail and dining options.

Demand for housing in an irreplaceable location, that is well-amenitized in supply-constrained Southside submarket remains strong, driven by UC Berkeley’s ongoing bed shortage and consistent student, staff and faculty population growth. Rent growth in the area has increased by 25% over the past 10 years, and is projected to exceed 23% through 2035. This, combined with the Leroy's classic construction, irreplaceable location, and significant rent upside, makes the Property an exceptional opportunity for investors seeking both stable in-place income and long-term capital appreciation.

The property may be purchased individually or as a 3 property, 68-unit portfolio with The Keystone Apartments (2419 Durant Ave - 32 Units) and The Castle Craig Apartments (2525 Durant Ave - 27 Units).

BILAN FINANCIER (PRO FORMA - 2025) |

ANNUEL (CAD) | ANNUEL PAR pi² (CAD) |

|---|---|---|

| Revenu de location brut |

370 543 $

|

66,13 $

|

| Autres revenus |

14 984 $

|

2,67 $

|

| Perte due à l’inoccupation |

18 527 $

|

3,31 $

|

| Revenu brut effectif |

366 999 $

|

65,50 $

|

| Taxes |

68 961 $

|

12,31 $

|

| Dépenses d’exploitation |

55 065 $

|

9,83 $

|

| Total des dépenses |

124 025 $

|

22,14 $

|

| Revenu net d’exploitation |

242 974 $

|

43,36 $

|

BILAN FINANCIER (PRO FORMA - 2025)

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | 370 543 $ |

| Annuel par pi² | 66,13 $ |

| Autres revenus (CAD) | |

|---|---|

| Annuel | 14 984 $ |

| Annuel par pi² | 2,67 $ |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | 18 527 $ |

| Annuel par pi² | 3,31 $ |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | 366 999 $ |

| Annuel par pi² | 65,50 $ |

| Taxes (CAD) | |

|---|---|

| Annuel | 68 961 $ |

| Annuel par pi² | 12,31 $ |

| Dépenses d’exploitation (CAD) | |

|---|---|

| Annuel | 55 065 $ |

| Annuel par pi² | 9,83 $ |

| Total des dépenses (CAD) | |

|---|---|

| Annuel | 124 025 $ |

| Annuel par pi² | 22,14 $ |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | 242 974 $ |

| Annuel par pi² | 43,36 $ |

FAITS SUR LA PROPRIÉTÉ En dépôt fiduciaire

| Prix | 4 349 499 $ CAD | Style d’appartement | De faible hauteur |

| Prix par unité | 483 278 $ CAD | Classe d’immeuble | C |

| Type de vente | Investissement | Taille du lot | 0,15 AC |

| Taux de capitalisation | 5,59% | Taille du bâtiment | 5 603 pi² |

| Multiplicateur du loyer brut | 11.74 | Nombre d’étages | 3 |

| Nombre d’unités | 9 | Année de construction | 1917 |

| Type de propriété | Immeuble residentiel | Ratio de stationnement | 1,78/1 000 pi² |

| Sous-type de propriété | Appartement | ||

| Zonage | R-SMU | ||

| Prix | 4 349 499 $ CAD |

| Prix par unité | 483 278 $ CAD |

| Type de vente | Investissement |

| Taux de capitalisation | 5,59% |

| Multiplicateur du loyer brut | 11.74 |

| Nombre d’unités | 9 |

| Type de propriété | Immeuble residentiel |

| Sous-type de propriété | Appartement |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | C |

| Taille du lot | 0,15 AC |

| Taille du bâtiment | 5 603 pi² |

| Nombre d’étages | 3 |

| Année de construction | 1917 |

| Ratio de stationnement | 1,78/1 000 pi² |

| Zonage | R-SMU |

UNITÉ RENSEIGNEMENTS SUR LE MÉLANGE

| DESCRIPTION | NOMBRE D’UNITÉS | LOYER MOYEN/MOIS | pi² |

|---|---|---|---|

| Studios | 4 | 3 330 $ CAD | 450 |

| 2+1 | 5 | 4 856 $ CAD | 900 |

1 1

Walk Score®

Un paradis pour un marcheur (99)

Bike Score®

Un paradis pour un cycliste (93)

Impôts fonciers

| Numéro de lot | 055-1878-012-00 | Évaluation totale | 605 012 $ CAD |

| Évaluation du terrain | 310 525 $ CAD | Impôts annuels | 68 961 $ CAD (12,31 $ CAD/pi²) |

| Évaluation des bâtiments | 294 486 $ CAD | Année d’imposition | 2025 |

Impôts fonciers

Numéro de lot

055-1878-012-00

Évaluation du terrain

310 525 $ CAD

Évaluation des bâtiments

294 486 $ CAD

Évaluation totale

605 012 $ CAD

Impôts annuels

68 961 $ CAD (12,31 $ CAD/pi²)

Année d’imposition

2025

1 de 26

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

1 de 1

Présenté par

LEROY APARTMENTS | 9 Units | Steps From Cal | 2411 Durant Ave

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.