Se Connecter/S’inscrire

Votre courriel a été envoyé.

Bldg A 2505 W Shaw Ave 10 120 pi² 100% Loué Bureau Immeuble Fresno, CA 93711 2 908 311 $ CAD (287,38 $ CAD/pi²)

Certaines informations ont été traduites automatiquement.

RÉSUMÉ DE L'ANNONCE

RC Commercial proudly presents a turnkey, 100% occupied medical office investment in the heart of Fresno's thriving West Shaw Financial Park. This exceptional property offers stable cash flow, long-term leases, and modern upgrades—ideal for investors seeking reliable returns in a resilient healthcare sector.

Property Highlights

Building Size: ~10,120 SF office building on .94 acres

Occupancy: 100% leased to three quality medical tenants

Recent Upgrades: LED lighting, fresh paint, new flooring, and multiple HVAC replacements—no deferred maintenance

Lease Structure: Triple Net (NNN) leases shift expenses to tenants

Location Benefits: Prime visibility in a professional business park with easy access to Fresno's growing medical and financial hubs

Stable Tenant Mix & Income

All tenants enjoy 5-year leases (commencing 2024) with 5-year renewal options and built-in rent escalations in 2026 for growing returns:

Speech Therapy Link ~6,135 SF | $7,362/month + NNN (escalates to $7,730.10/month in May 2026)

Easter Seals Central California ~3,482 SF | $4,178.40/month + NNN (escalates to $4,387.30/month in July 2026)

Civilized Technology Systems ~389 SF | $466.80/month + NNN (escalates to $490.14/month in June 2026)

Investment Metrics: Offered at $2,100,000 with a strong 6.9% CAP Rate

This diversified tenant base in the resilient medical sector ensures reliable income and low vacancy risk.

Why Invest Now?

Resilient Asset Class: Medical offices maintain high demand amid Fresno's population growth and aging demographics

Low-Risk Profile: Fully leased with creditworthy tenants and minimal capex needs

Value-Add Potential: Renewal options and escalations position for income growth

Market Edge: Competitive CAP rate in a supply-constrained submarket

Seize this rare opportunity for immediate cash flow and long-term appreciation in one of California's most affordable growth markets.

Property Highlights

Building Size: ~10,120 SF office building on .94 acres

Occupancy: 100% leased to three quality medical tenants

Recent Upgrades: LED lighting, fresh paint, new flooring, and multiple HVAC replacements—no deferred maintenance

Lease Structure: Triple Net (NNN) leases shift expenses to tenants

Location Benefits: Prime visibility in a professional business park with easy access to Fresno's growing medical and financial hubs

Stable Tenant Mix & Income

All tenants enjoy 5-year leases (commencing 2024) with 5-year renewal options and built-in rent escalations in 2026 for growing returns:

Speech Therapy Link ~6,135 SF | $7,362/month + NNN (escalates to $7,730.10/month in May 2026)

Easter Seals Central California ~3,482 SF | $4,178.40/month + NNN (escalates to $4,387.30/month in July 2026)

Civilized Technology Systems ~389 SF | $466.80/month + NNN (escalates to $490.14/month in June 2026)

Investment Metrics: Offered at $2,100,000 with a strong 6.9% CAP Rate

This diversified tenant base in the resilient medical sector ensures reliable income and low vacancy risk.

Why Invest Now?

Resilient Asset Class: Medical offices maintain high demand amid Fresno's population growth and aging demographics

Low-Risk Profile: Fully leased with creditworthy tenants and minimal capex needs

Value-Add Potential: Renewal options and escalations position for income growth

Market Edge: Competitive CAP rate in a supply-constrained submarket

Seize this rare opportunity for immediate cash flow and long-term appreciation in one of California's most affordable growth markets.

FAITS SUR LA PROPRIÉTÉ

Type de vente

Investissement pour loyer hypernet

Type de propriété

Bureau

Taille du bâtiment

10 120 pi²

Classe d’immeuble

C

Année de construction

1979

Prix

2 908 311 $ CAD

Prix par pi²

287,38 $ CAD

Pourcentage loué

100%

Location

Multiples

Hauteur du bâtiment

1 étage

Superficie de plancher typique

10 120 pi²

Dalle à dalle

8’

Coefficient d’occupation des sols de l’immeuble

0,49

Taille du lot

0,47 AC

Zonage

C-P

Stationnement

30 places (1,42 places par 1 000 pi² loué)

COMMODITÉS

- Affichage

1 1

Impôts fonciers

| Numéro de lot | 424-580-35 | Évaluation des bâtiments | 881 638 $ CAD |

| Évaluation du terrain | 349 230 $ CAD | Évaluation totale | 1 230 868 $ CAD |

Impôts fonciers

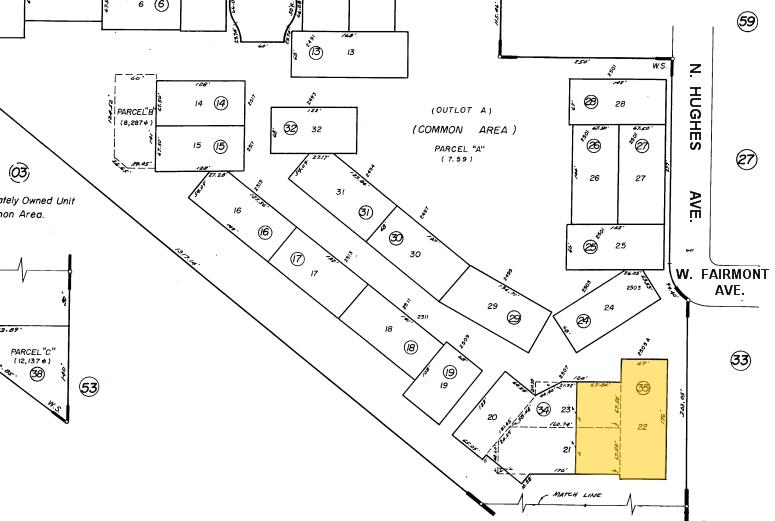

Numéro de lot

424-580-35

Évaluation du terrain

349 230 $ CAD

Évaluation des bâtiments

881 638 $ CAD

Évaluation totale

1 230 868 $ CAD

1 de 13

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

1 de 1

Présenté par

Bldg A | 2505 W Shaw Ave

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.