Votre courriel a été envoyé.

Prime Real Estate - $6,500,000 495 E Holt Ave 14 490 pi² Commerce de détail Immeuble Pomona, CA 91767 8 960 250 $ CAD (618,37 $ CAD/pi²) 7,57% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

FAITS SAILLANTS DE L'INVESTISSEMENT

- PRIME HARD CORNER SIGNALIZED INTERSECTION

- Absolute NNN lease – zero landlord responsibilities

- 7.5% cap rate with future repositioning or redevelopment upside

- ADT Volume over 47,000 Vehicles Per Day

- Prime Holt Ave frontage with drive-thru and signalized access

- Corporate tenant paying $41,000/month NNN through Aug 2028

RÉSUMÉ DE L'ANNONCE

• Prime real estate adjacent to McDonalds, hard corner signalized intersection.

• Corporate Credit Income – Walgreens Co. continues to pay $492,000 annually (NNN) with ~3 years remaining, offering predictable income from a Fortune 500 tenant.

• Absolute NNN Lease – No landlord expenses; tenant covers all property taxes, insurance, and maintenance, providing passive, bond-like income.

• High Yield Opportunity – At a $6.5M offering price, the property delivers an attractive 7.5% cap rate, exceeding current yields for comparable short-term credit assets.

• Prime Real Estate – Freestanding ±14,500 SF building with drive-thru and signalized Holt Avenue frontage (±47,000 vehicles per day at intersection).

• Flexible Exit Strategy – Near-term lease expiration allows for multiple repositioning options: re-tenanting, medical conversion, or redevelopment.

• Strong Underlying Land Value – ±1.25-acre parcel with high visibility and access in the core Pomona retail corridor, adjacent to national brands (McDonald’s, Smart & Final, AutoZone).

• 1031 Exchange Ready – Ideal for investors seeking stable NNN income with residual land upside and minimal management responsibility.

C-4 General Commercial allows a wide range of retail, service, office, and limited light commercial uses (think medical, restaurant, showroom, auto-related, or general merchandise).

Under the East Holt Corridor District overlay (Pomona Corridors Specific Plan), the city encourages reinvestment, adaptive reuse, and mixed commercial redevelopment along Holt Avenue. Pharmacy use is restricted only by Walgreens’ lease covenant, not by zoning.

Future potential uses include:

Medical / Urgent Care / Dental

Retail or Service Commercial

Restaurant or Drive-Thru

Fitness / Health / Training

Office or Administrative

Potential mixed-use redevelopment (with CUP)

All information contained herein is obtained from sources deemed reliable but is not guaranteed. Broker makes no representation, warranty, or guarantee as to the accuracy of the information, including but not limited to square footage, income, expenses, zoning, or condition of the property. Prospective buyers are advised to verify all information independently and conduct their own due diligence. Property is offered subject to prior sale, lease, or withdrawal without notice.

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à |

ANNUEL (CAD) | ANNUEL PAR pi² (CAD) |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Revenu net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | $99,999 |

| Annuel par pi² | $9.99 |

FAITS SUR LA PROPRIÉTÉ

COMMODITÉS

- Ligne d'autobus

- Enseigne sur pylône

- Affichage

- Service au volant

- Station de recharge de voiture

PRINCIPAUX LOCATAIRES Cliquez ici pour accéder à

- LOCATAIRE

- SECTEUR

- pi² OCCUPÉ

- LOYER/pi²

- TYPE DE BAIL

- FIN DU BAIL

-

- Détaillant

- -

- -

-

Lorem Ipsum

-

Jan 0000

Walgreens, founded by Charles Rudolph Walgreen in 1901 in Chicago, is a major U.S. pharmacy and retail chain operating under the publicly traded parent, Walgreens Boots Alliance (NASDAQ: WBA). Headquartered in Deerfield, Illinois, it provides prescription services, health and wellness products, photo services, and expanded healthcare offerings including immunizations and diagnostic screenings. As of late 2025, the company operated thousands of retail locations across the United States and Puerto Rico, serving roughly 78% of Americans within five miles of a store. Walgreens maintains omnichannel operations—blending in-store, online, drive-thru, and home delivery services—and has strategic healthcare partnerships, notably with VillageMD. Under the direction of new CEO Mike Motz, following the August 2025 purchase by Sycamore Partners, Walgreens continues to emphasize core pharmacy execution, digital innovation, and integrated care solutions.

| LOCATAIRE | SECTEUR | pi² OCCUPÉ | LOYER/pi² | TYPE DE BAIL | FIN DU BAIL | |

|

Détaillant | - | - | Lorem Ipsum | Jan 0000 |

PRINCIPAUX DÉTAILLANTS À PROXIMITÉ

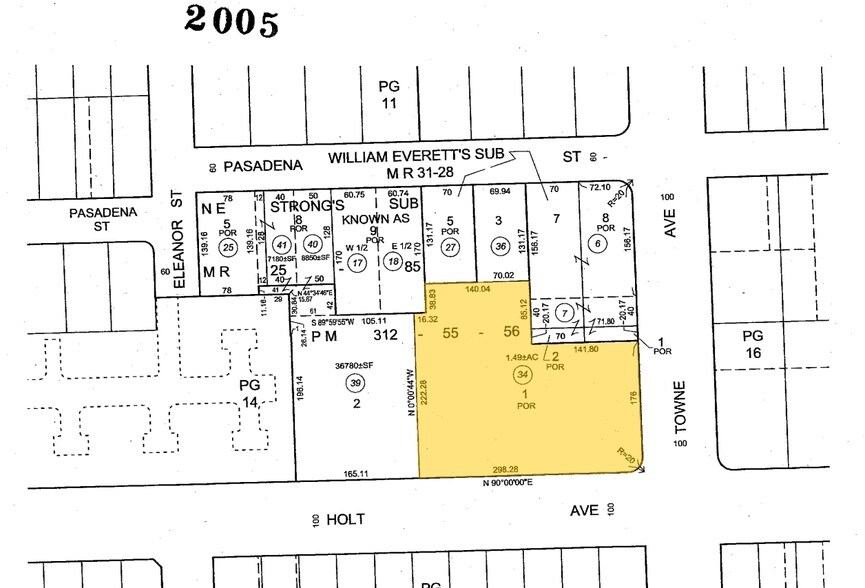

Impôts fonciers

| Numéro de lot | 8337-015-034 | Évaluation des bâtiments | 5 335 877 $ CAD (2025) |

| Évaluation du terrain | 7 693 139 $ CAD (2025) | Évaluation totale | 13 029 015 $ CAD (2025) |

Impôts fonciers

Présenté par

Prime Real Estate - $6,500,000 | 495 E Holt Ave

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.