Se Connecter/S’inscrire

Votre courriel a été envoyé.

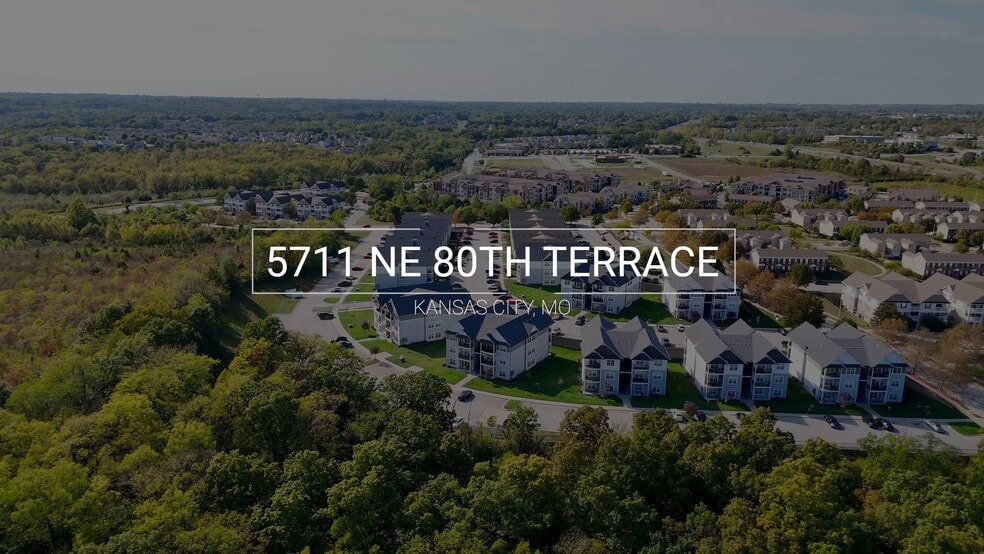

Brighton Crossing Apartments 5711 NE 80th Ter 18 Unité Immeuble d’appartements 3 805 788 $ CAD (211 433 $ CAD/Unité) 6,06% Taux de capitalisation Kansas City, MO 64119

Certaines informations ont été traduites automatiquement.

FAITS SAILLANTS DE L'INVESTISSEMENT

- Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations

- 100% Occupied

- Conveniently situated Off of 152 & N. Brighton Ave, we’re just minutes away from Downtown Kansas City and the Kansas City International Airport.

RÉSUMÉ DE L'ANNONCE

Turnkey Class A Multifamily | 18 Units in KC Growth Corridor

Midwest CRE Advisors is pleased to present a rare opportunity to acquire a virtually new, 18-unit Class A multifamily asset located in one of Kansas City’s most dynamic and rapidly growing corridors. Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations — perfectly positioned for both stability and immediate revenue optimization.

With Kansas City leading national rent growth at 3.1% annually and new multifamily deliveries slowing (only 861 units delivered YTD 2025 vs. 2,001 during the same period in 2024), this submarket is experiencing tightening supply and sustained rental demand. The combination of below-market rents, strong fundamentals, and limited new competition creates a compelling value-add scenario for investors seeking both current cash flow and future upside.

Residents benefit from MGC’s Resident Benefits Package ($33/month), which enhances retention and revenue through added-value services — including liability insurance, $10K personal coverage, credit reporting, identity protection, and rewards programs.

This offering represents a unique chance to acquire a modern multifamily investment in a market that continues to outperform national averages. With strong market fundamentals and clear operational upside, this property is poised to deliver long-term value to investors.

Investment Highlights

- Virtually New Construction (Built 2020)- Premium Class A multifamily asset with modern design, high-end finishes, and minimal maintenance requirements.

- Strong Market Fundamentals - Kansas City continues to outperform nationally with 3.1% annual rent growth, sustained absorption, and limited new supply.

- Deliveries Slowing, Demand Rising - Only 861 multifamily units delivered YTD 2025, compared to 2,001 during the same period in 2024 — driving rental rate stability and absorption.

- Immediate Value-Add Potential - Below-market rents and strategic management opportunities allow for NOI growth and enhanced investor returns.

- Resident Benefits Package Revenue Stream - Each resident enrolled in a $33/month RBP, adding ancillary income and promoting resident satisfaction through insurance, credit reporting, and rewards.

- Prime Location in Rapid-Growth Corridor - Positioned within one of Kansas City’s most dynamic growth areas — proximity to major employment hubs, retail, and new developments strengthens long-term appreciation.

- Stabilized Yet Scalable Investment - Attractive current cash flow with operational efficiencies and upside through rent optimization and potential expansion opportunities.

Midwest CRE Advisors is pleased to present a rare opportunity to acquire a virtually new, 18-unit Class A multifamily asset located in one of Kansas City’s most dynamic and rapidly growing corridors. Built in 2020, this turnkey property offers modern design, premium finishes, and low-maintenance operations — perfectly positioned for both stability and immediate revenue optimization.

With Kansas City leading national rent growth at 3.1% annually and new multifamily deliveries slowing (only 861 units delivered YTD 2025 vs. 2,001 during the same period in 2024), this submarket is experiencing tightening supply and sustained rental demand. The combination of below-market rents, strong fundamentals, and limited new competition creates a compelling value-add scenario for investors seeking both current cash flow and future upside.

Residents benefit from MGC’s Resident Benefits Package ($33/month), which enhances retention and revenue through added-value services — including liability insurance, $10K personal coverage, credit reporting, identity protection, and rewards programs.

This offering represents a unique chance to acquire a modern multifamily investment in a market that continues to outperform national averages. With strong market fundamentals and clear operational upside, this property is poised to deliver long-term value to investors.

Investment Highlights

- Virtually New Construction (Built 2020)- Premium Class A multifamily asset with modern design, high-end finishes, and minimal maintenance requirements.

- Strong Market Fundamentals - Kansas City continues to outperform nationally with 3.1% annual rent growth, sustained absorption, and limited new supply.

- Deliveries Slowing, Demand Rising - Only 861 multifamily units delivered YTD 2025, compared to 2,001 during the same period in 2024 — driving rental rate stability and absorption.

- Immediate Value-Add Potential - Below-market rents and strategic management opportunities allow for NOI growth and enhanced investor returns.

- Resident Benefits Package Revenue Stream - Each resident enrolled in a $33/month RBP, adding ancillary income and promoting resident satisfaction through insurance, credit reporting, and rewards.

- Prime Location in Rapid-Growth Corridor - Positioned within one of Kansas City’s most dynamic growth areas — proximity to major employment hubs, retail, and new developments strengthens long-term appreciation.

- Stabilized Yet Scalable Investment - Attractive current cash flow with operational efficiencies and upside through rent optimization and potential expansion opportunities.

SALLE DE DONNÉES Cliquez ici pour accéder à

FAITS SUR LA PROPRIÉTÉ

| Prix | 3 805 788 $ CAD | Style d’appartement | De faible hauteur |

| Prix par unité | 211 433 $ CAD | Classe d’immeuble | B |

| Type de vente | Investissement | Taille du lot | 0,92 AC |

| Taux de capitalisation | 6,06% | Taille du bâtiment | 15 581 pi² |

| Nombre d’unités | 18 | Occupation moyenne | 100% |

| Type de propriété | Immeuble residentiel | Nombre d’étages | 3 |

| Sous-type de propriété | Appartement | Année de construction | 2020 |

| Prix | 3 805 788 $ CAD |

| Prix par unité | 211 433 $ CAD |

| Type de vente | Investissement |

| Taux de capitalisation | 6,06% |

| Nombre d’unités | 18 |

| Type de propriété | Immeuble residentiel |

| Sous-type de propriété | Appartement |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | B |

| Taille du lot | 0,92 AC |

| Taille du bâtiment | 15 581 pi² |

| Occupation moyenne | 100% |

| Nombre d’étages | 3 |

| Année de construction | 2020 |

COMMODITÉS

COMMODITÉS DES UNITÉS

- Climatisation

- Balcon

- Prêt pour le câble

- Lave-vaisselle

- Traitement des déchets

- Micro-ondes

- Laveuse/Sécheuse

- Ventilateurs de plafond

- Comptoirs de granit

- Planchers de bois franc

- Réfrigérateur

- Four

- Électroménagers en acier inoxydable

- Fourchette

- Terrasse

- Salle de séjour

- Garde-manger

COMMODITÉS DU SITE

- Accès 24 heures

- Accès contrôlé

- Installations de lessive

- CVCA contrôlé par le locataire

- Salle de bain privée

UNITÉ RENSEIGNEMENTS SUR LE MÉLANGE

| DESCRIPTION | NOMBRE D’UNITÉS | LOYER MOYEN/MOIS | pi² |

|---|---|---|---|

| Studios | 6 | - | 497 |

| 1+1 | 12 | - | 650 - 731 |

1 1

1 de 17

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

1 de 1

Présenté par

Brighton Crossing Apartments | 5711 NE 80th Ter

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.