Se Connecter/S’inscrire

Votre courriel a été envoyé.

6740 N Oracle Rd 12 720 pi² Bureau Immeuble Tucson, AZ 85704 5 532 137 $ CAD (434,92 $ CAD/pi²) 6,75% Taux de capitalisation

Certaines informations ont été traduites automatiquement.

RÉSUMÉ DE L'ANNONCE

DESCRIPTION: 6740 N. Oracle Road is a single-story 12,720 square foot, garden-style office building that has been fully leased by Action Behavior Centers. A tenant in the building since 2021, Action Behavior Centers recently expanded from 6,511 square feet to now occupy the entire building. The expansion resulted in a lease extension through March 31 of 2033 with a lease that features 3% annual increases.

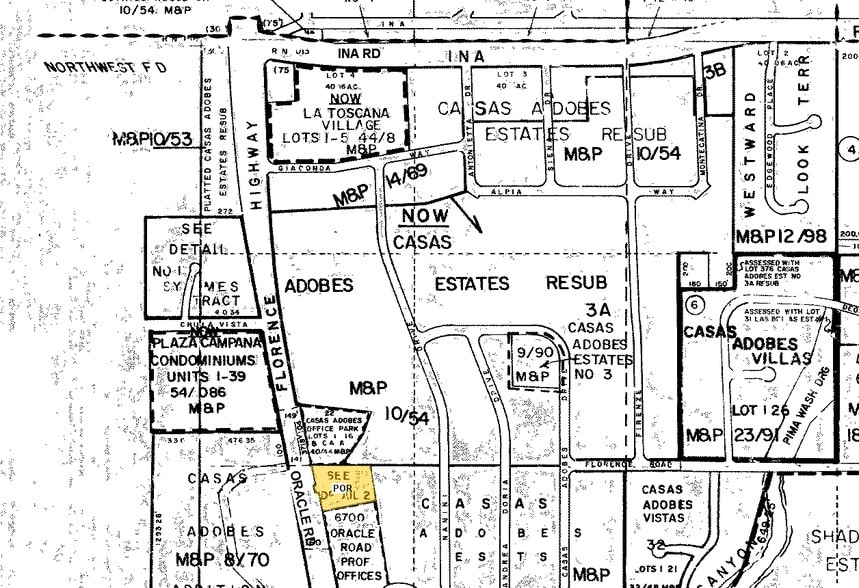

LOCATION: The property is located at 6740 N. Oracle Road, in the heart of the northwest Tucson. Tucson is home to the University of Arizona and is the second largest city in Arizona, with a population of just over 1,000,000 in the greater Tucson metropolitan statistical area. The property is located on Oracle Road (State Highway 77), just south of Ina Road intersection, which is one of the busiest intersections in Northwest Tucson. Its location is strategically located between the affluent communities of the Catalina Foothills and Oro Valley.

TENANT PROFILE: Action Behavior Centers (“ABC”) is one of the nation’s fastest growing Applied Behavior Analysis (“ABA”) therapy providers, widely considered the gold standard in autism treatment by payors and clinicians. ABC provides personalized therapy for children with autism, with the goal of expanding their potential and improving their quality of life. Founded as a single center in Austin, TX, in 2016, ABC currently employs approximately 400 graduate-level clinicians and operates almost 400 centers throughout the United States including over 50 in Arizona. In September of 2022 Action Behavior Centers sold to Charlesbank Capital Partners at an $840 million valuation and $60 million in projected annual adjusted earnings. Charlesbank’s investment validated ABC’s position as a leading ABA provider with strong clinical outcomes, a unique culture that supports clinician retention, and a data-driven management team. Per Charlesbank at the time of the purchase, their investment “will enable the company to add centers in both new and existing geographies to meet increasing patient demand while maintaining strong clinical outcomes.”

LEASE TYPE: The lease is a Modified Gross Lease with 3% annual increases. Tenant is responsible for pass-throughs of operating expenses over a 2022 Base Year. A full financial analysis of the lease, including the annual projected Net Operating Income and Cap Rates, is included in the Financial Analysis section of the Offering Memorandum.

LOCATION: The property is located at 6740 N. Oracle Road, in the heart of the northwest Tucson. Tucson is home to the University of Arizona and is the second largest city in Arizona, with a population of just over 1,000,000 in the greater Tucson metropolitan statistical area. The property is located on Oracle Road (State Highway 77), just south of Ina Road intersection, which is one of the busiest intersections in Northwest Tucson. Its location is strategically located between the affluent communities of the Catalina Foothills and Oro Valley.

TENANT PROFILE: Action Behavior Centers (“ABC”) is one of the nation’s fastest growing Applied Behavior Analysis (“ABA”) therapy providers, widely considered the gold standard in autism treatment by payors and clinicians. ABC provides personalized therapy for children with autism, with the goal of expanding their potential and improving their quality of life. Founded as a single center in Austin, TX, in 2016, ABC currently employs approximately 400 graduate-level clinicians and operates almost 400 centers throughout the United States including over 50 in Arizona. In September of 2022 Action Behavior Centers sold to Charlesbank Capital Partners at an $840 million valuation and $60 million in projected annual adjusted earnings. Charlesbank’s investment validated ABC’s position as a leading ABA provider with strong clinical outcomes, a unique culture that supports clinician retention, and a data-driven management team. Per Charlesbank at the time of the purchase, their investment “will enable the company to add centers in both new and existing geographies to meet increasing patient demand while maintaining strong clinical outcomes.”

LEASE TYPE: The lease is a Modified Gross Lease with 3% annual increases. Tenant is responsible for pass-throughs of operating expenses over a 2022 Base Year. A full financial analysis of the lease, including the annual projected Net Operating Income and Cap Rates, is included in the Financial Analysis section of the Offering Memorandum.

BILAN FINANCIER (PRO FORMA - 2026) |

ANNUEL (CAD) | ANNUEL PAR pi² (CAD) |

|---|---|---|

| Revenu de location brut |

477 207 $

|

37,52 $

|

| Autres revenus |

-

|

-

|

| Perte due à l’inoccupation |

-

|

-

|

| Revenu brut effectif |

477 207 $

|

37,52 $

|

| Taxes |

-

|

-

|

| Dépenses d’exploitation |

-

|

-

|

| Total des dépenses |

103 770 $

|

8,16 $

|

| Revenu net d’exploitation |

373 437 $

|

29,36 $

|

BILAN FINANCIER (PRO FORMA - 2026)

| Revenu de location brut (CAD) | |

|---|---|

| Annuel | 477 207 $ |

| Annuel par pi² | 37,52 $ |

| Autres revenus (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Perte due à l’inoccupation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Revenu brut effectif (CAD) | |

|---|---|

| Annuel | 477 207 $ |

| Annuel par pi² | 37,52 $ |

| Taxes (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Dépenses d’exploitation (CAD) | |

|---|---|

| Annuel | - |

| Annuel par pi² | - |

| Total des dépenses (CAD) | |

|---|---|

| Annuel | 103 770 $ |

| Annuel par pi² | 8,16 $ |

| Revenu net d’exploitation (CAD) | |

|---|---|

| Annuel | 373 437 $ |

| Annuel par pi² | 29,36 $ |

FAITS SUR LA PROPRIÉTÉ

Type de vente

Investissement

Type de propriété

Bureau

Taille du bâtiment

12 720 pi²

Classe d’immeuble

B

Année de construction/rénovation

2000/2022

Prix

5 532 137 $ CAD

Prix par pi²

434,92 $ CAD

Taux de capitalisation

6,75%

Revenu net d’exploitation

373 436 $ CAD

Location

Unique

Hauteur du bâtiment

1 étage

Superficie de plancher typique

12 720 pi²

Coefficient d’occupation des sols de l’immeuble

0,29

Taille du lot

1,01 AC

Zonage

CB-1, County

COMMODITÉS

- Ligne d'autobus

PRINCIPAUX LOCATAIRES

- LOCATAIRE

- SECTEUR

- pi² OCCUPÉ

- LOYER/pi²

- TYPE DE BAIL

- FIN DU BAIL

- Action Behavior Centers

- Soins de santé et assistance sociale

- -

- -

- Brut modifié

- Mars 2033

| LOCATAIRE | SECTEUR | pi² OCCUPÉ | LOYER/pi² | TYPE DE BAIL | FIN DU BAIL | |

| Action Behavior Centers | Soins de santé et assistance sociale | - | - | Brut modifié | Mars 2033 |

Impôts fonciers

| Numéro de lot | 102-03-150H | Évaluation des bâtiments | 0 $ CAD (2025) |

| Évaluation du terrain | 0 $ CAD (2025) | Évaluation totale | 346 372 $ CAD (2025) |

Impôts fonciers

Numéro de lot

102-03-150H

Évaluation du terrain

0 $ CAD (2025)

Évaluation des bâtiments

0 $ CAD (2025)

Évaluation totale

346 372 $ CAD (2025)

1 de 6

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D MATTERPORT

PHOTOS

VUE DEPUIS LA RUE

RUE

CARTE

Présenté par

6740 N Oracle Rd

Vous êtes déjà membre? Connectez-vous

Hmm, il semble y avoir eu une erreur lors de l’envoi de votre message. Veuillez réessayer.

Merci! Votre message a été envoyé.