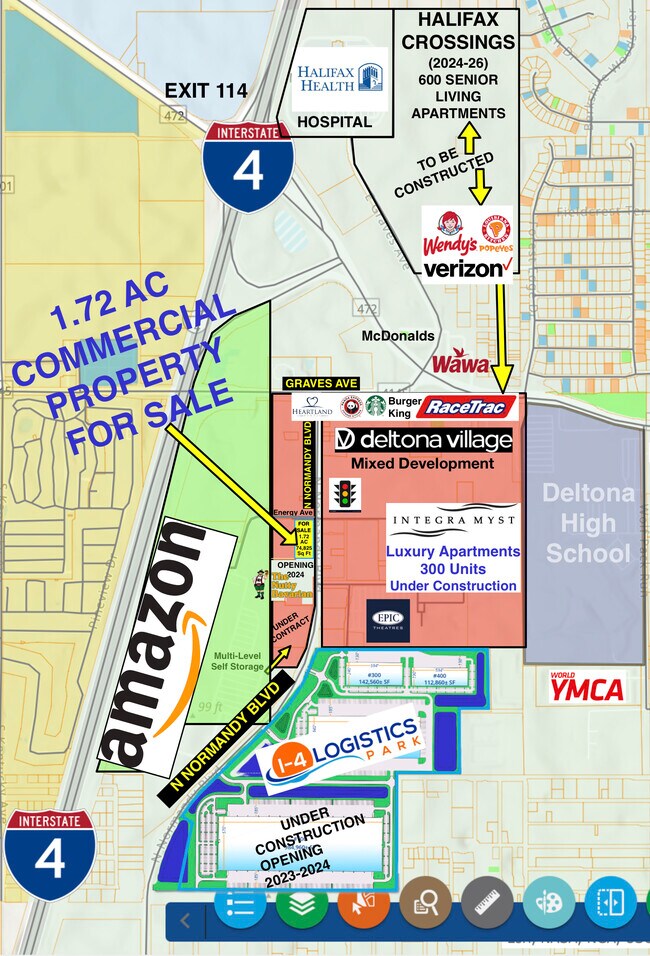

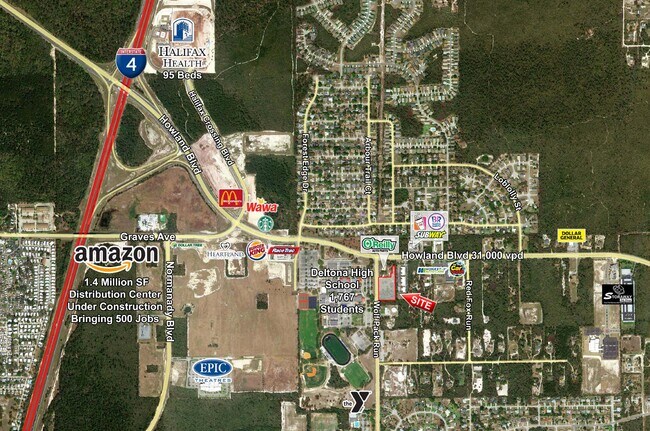

Deltona Pine View

Deltona, FL 32725

- Fulfillment Center

- Land for Sale

- $2,600,131 CAD

- 6.26 AC Lot

A fulfillment center is a large warehouse that stores and processes customer orders. It's also often referred to as a "fulfillment house." A single fulfillment center can handle all of an online retailer's inventory, or just part of it.

When online retailers use fulfillment centers, they have the option of shipping products directly to consumers from a warehouse or storing the inventory in a fulfillment center and then having it shipped to consumers on their behalf. Fulfillment and distribution businesses are responsible for picking, packing, shipping, and customer service.

Fulfillment centers work with e-commerce retailers by receiving customer orders at the beginning of the day and shipping them out as quickly as possible. They tend to focus on processes over technology. Fulfillment warehouses usually have large floorspace for retail space that is not optimized for high speed but rather storage density due to low ceilings and/or relatively short distances between racks of product. The realization that such floor plans are less desirable than ones with higher ceilings and better use of aisle space are beginning to change how some of the largest fulfillment warehouses are being designed as well as pushing for their inclusion in existing facilities.

Both the distribution center and the fulfillment center are warehouse facilities that handle inventory. However, there is a difference between these two models. A distribution center may also be used to store goods in transit from suppliers or products awaiting transportation to a customer, whereas fulfillment centers usually do not receive shipments on behalf of other businesses.

A fulfillment center's main function is packing and delivering orders placed online, while a distribution center focuses more on storing boxed items waiting for shipment. Apart from this distinction, fulfillment and distribution warehouses share many similar characteristics: They're large-format with high ceilings; they house hundreds of thousands of square feet in order to meet short deadlines; they feature automated storage and retrieval systems (AS/RS); they are strategically located near major transportation hubs; and they require dedicated IT infrastructure.

The biggest difference between a warehouse and a fulfillment center is in the type of inventory stored in the facility. A warehouse contains product for retail outlets, while a fulfillment center's inventory is sold directly to consumers via the Internet or catalogs. Fulfillment centers store products that are typically ordered online by consumers and used within 30-90 days. Orders arrive at the distribution center on pallets from suppliers or other warehouses; workers unload these pallets onto conveyor belts and sort them into one of many merchandise bins that may contain similar items. When an order comes through, it goes to work with more personal service (for example, sending a book to one customer, and a CD to another). This order is then assigned to one of many packing stations and given an address label.

When an online retailer is unable to keep up with the fast pace of orders placed through their website, they hire fulfillment centers to help them process and ship incoming orders. There are many reasons why retailers outsource this service - some of which include:

Order volume – Online sales continue to grow steadily year after year. Fulfillment centers have a greater capacity for order fulfillment than most retail locations because they're able to handle high volumes from multiple e-commerce websites, as well as fulfill individual customer orders.

Inventory storage – Retailers often sell items at different times throughout the year such as summer apparel or winter goods that aren't in high demand until the appropriate season arrives. They can store these products at a fulfillment center, freeing up valuable space.

The economics of the fulfillment center business continues to revolve around efficiency. Fulfillment centers, on average, are projected to grow annually year over year. Greater public awareness of the importance fulfillment centers play in online retail and their contribution to the economy will likely make it easier for them to address overall shortages that are projected to increase in the coming years.

In the last decade, fulfillment centers have shifted their focus to provide e-commerce retailers with speedy and cost-effective solutions in order to help them stay competitive.

Looking to lease a Fulfillment Center? View Fulfillment Centers for lease